Good afternoon,

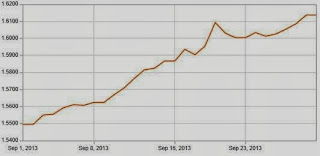

Since my last post Sterling has climbed nearly two cents to reach $1.62, the highest GBP/USD exchange rates have been since the 3rd January. The pounds performance has been boosted by the news the U.S government is facing a shut down at midnight (EST) unless a new spending bill can be agreed. For more information on live exchange rates click here.

Unless a new plan is agreed before midnight it means from the 1st of October the U.S Government will be forced to shut down for the first time in 17 years. Millions of employees are expected to stop work potentially leaving the U.S economy in a state of disarray.

It is rumoured that a shutdown would last for a couple of weeks which would see any chance of the U.S economy recovering in the short term coming being completely wiped out. Not only will the U.S dollar lose ground against all it's major counterparts on the back of the initial shutdown, it will also mean the Federal Reserve will have to wait even longer to begin tapering, causing even greater loses.

For commercial rate of exchange click here

With the FED wanting to see continued improvement in the U.S economy before scaling back their on going stimulus programme todays news will come as a bitter blow to Chairman Ben Bernanke.

Lets not forget that the U.S government is also facing a battle not to reach their debt ceiling on the 17th October so the next couple of weeks are going to be critical for the future of the economy and the dollar.

Of course if a plan is agreed and a shutdown is avoided the dollar may claw back some of the losses we have seen today. If you need to buy or sell dollars and are worried about exchange rates moving against you simply use the link below to complete the contact form or call me directly on 0044 (0) 1422 892 065 for a free, no-obligation consultation.

Click here to complete the contact form

Market Reports published by Senior Currency Broker Arron Morris, forecasts and data that can impact pound/dollar exchange rates. Used by those that need to buy or sell U.S Dollars at commercial exchange rates. Our rates are better than those available at banks or other financial institutions, so contact me today to see how much you can save on your currency transaction.

Monday 30 September 2013

Thursday 26 September 2013

Pound dollar exchange rate update

Good afternoon,

It has been a fairly choppy couple of days for the GBP/USD cross with exchanges rates pushing close to $1.61 this morning before dropping back down towards $1.60 by the middle of the afternoon. In todays post we will take a closer look at what has caused the movement and what we can expect in the coming weeks. For more information on live market prices click here.

Sterling was unable to make the most of the positive GDP result as moments later it emerged that the UK trade balance had widened by £2billion more than had been forecast. The news had a negative impact on the pounds performance over the course of trading today as the graph below shows.

It has been a fairly choppy couple of days for the GBP/USD cross with exchanges rates pushing close to $1.61 this morning before dropping back down towards $1.60 by the middle of the afternoon. In todays post we will take a closer look at what has caused the movement and what we can expect in the coming weeks. For more information on live market prices click here.

This morning saw the release of the final Gross Domestic Product (GDP) figures for quarter two of 2013. Figures released by the Office of National Statistics caused little surprise and came in exactly as forecast at 0.7%. Although the figures are positive for the UK economy it did cause a huge amount of movement in the FX markets as I suspect it was already being priced into the market.

Sterling was unable to make the most of the positive GDP result as moments later it emerged that the UK trade balance had widened by £2billion more than had been forecast. The news had a negative impact on the pounds performance over the course of trading today as the graph below shows.

What are the predictions for the pound/dollar forecast?

The next few weeks are going to be critical for the U.S government and the dollar. Over the last few months all of the talk has been about the U.S Federal Reserve and when they will begin tapering, which is one of the reasons we have seen exchange rates break over $1.60 in the last seven days.

That is all about to change though, as it has emerged that the U.S are close to reaching their debt limit and unless President Obama and the Republicans can come to some sort of agreement it will leave the country unable to meet their financial commitments.

If that were to happen it would cause the dollars value to drop even more than it has done in recent weeks which in turn would push GBP/USD exchange rates even higher. However, just to underline how unpredictable the currency markets can be, one of my brokers are still predicting that Sterling/dollar rates will drop below $1.48 in the coming months.

If you are worried about which way exchange rates are heading use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 (quoting ADM blog) for a free, no-obligation consultation.

Tuesday 24 September 2013

SGBP/USD exchange rates drop back below $1.60

Good afternoon,

GBP/USD exchange rates dipped back below $1.60 today as positive news regarding U.S house prices and an increase in safe-haven flows helped strengthen the dollar. When trading opened this morning the mid-market price was hovering just below $1.6050 but with the markets still reacting to the German elections rates quickly moved back below towards the $1.60 mark. For more information on live market prices click here.

With Angela Merkel just missing out on a majority win in the recent German elections which has left the Chancellor needing to form a coalition, it has left a small cloud of uncertainty hanging over the Eurozone's largest economy. Any form of uncertainty, regardless of how small often causes some volatility in the FX markets and this is exactly what we have seen over the last 48 hours. This has lead to investors turning their attention back towards the so called safe-haven currencies and until the coalition is formed we may see safe-haven flows into the U.S help the dollar claw back more of the ground it has lost against the pound in the last couple of weeks.

For commercial rates of exchange click here.

There was also more positive news for the U.S this afternoon as house prices increased by 12.4% over the last twelve months, the biggest increase for over seven years! This news saw the dollars value increase which dropped exchange rates to a low of $1.5956 meaning GBP/USD has fallen nearly two cents is just under a week.

With the U.S economy producing some positive figures over the last week, it will not be long until the talk of tapering starts to surface again. Although the U.S Federal Reserve decided against taking any action last week, there are rumours the FED are still looking to reduce the amount of Quantitative Easing before the end of the year. All eyes will now turn to the U.S Job numbers that will be released at the start of October and a positive result could well see the dollar continue strengthen.

If you have a requirement to buy or sell dollars in the coming weeks it is important to know what tools are available to help you make the most from your currency transfer. So if you would like to know what exchange rates I can offer or would like more information on how to protect yourself against adverse market movements, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 (quoting ADM blog) for a free, no-obligation consultation.

Click here to complete the contact form.

GBP/USD exchange rates dipped back below $1.60 today as positive news regarding U.S house prices and an increase in safe-haven flows helped strengthen the dollar. When trading opened this morning the mid-market price was hovering just below $1.6050 but with the markets still reacting to the German elections rates quickly moved back below towards the $1.60 mark. For more information on live market prices click here.

With Angela Merkel just missing out on a majority win in the recent German elections which has left the Chancellor needing to form a coalition, it has left a small cloud of uncertainty hanging over the Eurozone's largest economy. Any form of uncertainty, regardless of how small often causes some volatility in the FX markets and this is exactly what we have seen over the last 48 hours. This has lead to investors turning their attention back towards the so called safe-haven currencies and until the coalition is formed we may see safe-haven flows into the U.S help the dollar claw back more of the ground it has lost against the pound in the last couple of weeks.

For commercial rates of exchange click here.

There was also more positive news for the U.S this afternoon as house prices increased by 12.4% over the last twelve months, the biggest increase for over seven years! This news saw the dollars value increase which dropped exchange rates to a low of $1.5956 meaning GBP/USD has fallen nearly two cents is just under a week.

With the U.S economy producing some positive figures over the last week, it will not be long until the talk of tapering starts to surface again. Although the U.S Federal Reserve decided against taking any action last week, there are rumours the FED are still looking to reduce the amount of Quantitative Easing before the end of the year. All eyes will now turn to the U.S Job numbers that will be released at the start of October and a positive result could well see the dollar continue strengthen.

If you have a requirement to buy or sell dollars in the coming weeks it is important to know what tools are available to help you make the most from your currency transfer. So if you would like to know what exchange rates I can offer or would like more information on how to protect yourself against adverse market movements, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 (quoting ADM blog) for a free, no-obligation consultation.

Click here to complete the contact form.

Friday 20 September 2013

GBP/USD rates hit fresh high

Good afternoon,

Firstly let me apologise for not posting anything for the last few days, computer issues prevented me from being able to sign into my blog, which considering how volatile the markets have been has been exceedingly frustrating!

The last 48 hours have seen some huge swings for the Sterling/dollar cross. On Wednesday U.S Federal Reserve (FED) Chairman Ben Bernanke announced there would be no change to the existing bond buying programme, which is currently seeing the FED inject $85 billion per month into the U.S economy. The dollar immediately suffered as GBP/USD exchange rates reached $1.6150 for the first time since the 11th January 2013. For more information on live market prices click here.

Speculation had been mounting in the build up to Mr Bernanke's announcement that this was the time the FED would begin to scale back the stimulus package. In fact, investors and market players were so sure this was going to be the case, meant the only question remaining was by how much it would be reduced. Mr Bernanke's decision has left everyone scratching their heads as he is basically saying the U.S economy is still in a state of emergency and that tapering would not begin until there are continued signs of improvement.

Want commercial rates of exchange? click here

However, the gains for Sterling have not lasted for very long. Yesterday morning the UK released its latest retail figures and with the result coming in well under forecast, the pound quickly dropped back to $1.6070. There was also some positive news for the dollar as Existing Home Sales and the Philly Fed Manufacturing Index both beat expectations to help claw back some of the ground the dollar had lost over the previous 24 hours. As I have mentioned it has been a volatile few days and at the time of writing the GBP/USD had dropped back to $1.6007, almost a cent and a half down from Thursday's high.

So what next?

With exchange rates unexpectedly sitting over $1.60 it is certainly an excellent time to purchase dollars and despite the recent drop, rates are still over 9 points high than at the start of August. If you are selling dollars all is not lost, the FED are still hopeful they will be in a position to begin tapering before the end of the year and if that is true there is every chance rates will move back in your favour.

If you need to buy or sell dollars in the coming months, leaving it to chance could prove very costly, especially as the FX markets have been extremely volatile recently. If you would like more information on how I can help and the exchange rates I can offer you can either use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 (quoting ADM blog) for a free, no-obligation consultation.

Click here to complete the contact form.

Firstly let me apologise for not posting anything for the last few days, computer issues prevented me from being able to sign into my blog, which considering how volatile the markets have been has been exceedingly frustrating!

The last 48 hours have seen some huge swings for the Sterling/dollar cross. On Wednesday U.S Federal Reserve (FED) Chairman Ben Bernanke announced there would be no change to the existing bond buying programme, which is currently seeing the FED inject $85 billion per month into the U.S economy. The dollar immediately suffered as GBP/USD exchange rates reached $1.6150 for the first time since the 11th January 2013. For more information on live market prices click here.

Speculation had been mounting in the build up to Mr Bernanke's announcement that this was the time the FED would begin to scale back the stimulus package. In fact, investors and market players were so sure this was going to be the case, meant the only question remaining was by how much it would be reduced. Mr Bernanke's decision has left everyone scratching their heads as he is basically saying the U.S economy is still in a state of emergency and that tapering would not begin until there are continued signs of improvement.

Want commercial rates of exchange? click here

However, the gains for Sterling have not lasted for very long. Yesterday morning the UK released its latest retail figures and with the result coming in well under forecast, the pound quickly dropped back to $1.6070. There was also some positive news for the dollar as Existing Home Sales and the Philly Fed Manufacturing Index both beat expectations to help claw back some of the ground the dollar had lost over the previous 24 hours. As I have mentioned it has been a volatile few days and at the time of writing the GBP/USD had dropped back to $1.6007, almost a cent and a half down from Thursday's high.

So what next?

With exchange rates unexpectedly sitting over $1.60 it is certainly an excellent time to purchase dollars and despite the recent drop, rates are still over 9 points high than at the start of August. If you are selling dollars all is not lost, the FED are still hopeful they will be in a position to begin tapering before the end of the year and if that is true there is every chance rates will move back in your favour.

If you need to buy or sell dollars in the coming months, leaving it to chance could prove very costly, especially as the FX markets have been extremely volatile recently. If you would like more information on how I can help and the exchange rates I can offer you can either use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 (quoting ADM blog) for a free, no-obligation consultation.

Click here to complete the contact form.

Monday 16 September 2013

Pound Dollar rates keep on rising.

Good afternoon,

It was a quite day in terms of data releases in the UK but that did not stop the pound rising to the highest level we have seen since mid-January. Following the news that Larry Summers has withdrawn from the race to take over from Ben Bernanke at the U.S Federal Reserve the dollar weakened against most of the major currencies and pushing the GBP/USD cross to a high of $1.5961. For more information on live currency prices click here.

Many thought that Larry Summers was President Obamas favourite to succeed current Chairman Ben Bernanke when he steps down from the role in January 2014. It is now leaves the door open for Janet Yellen who is the currently the vice-chairman at the FED to become the first women to be appointed in the role.

Whoever takes over from Mr Bernanke could well be appointed at a critical time for the Federal Reserve, as speculation continues to mount over the current bond buying programme. The question on everybody's lips at the moment is when will the FED look to start scaling back the current programme. There are rumours we could get an answer when the FOMC meet this week but with the U.S economy under performing it seems increasingly unlikely we will see any reduction in the short term. But stranger things have happened!

If you want a commercial rate of exchange click here.

If Mr Bernanke does decide to take action it will lead to the dollar clawing back some of the ground it has lost against the pound in the last few weeks. This will be great news for those that are looking to sell dollars as the rates have been moving against them since the start of August. How far exchange rates will fall is impossible to say but given how well the UK and Sterling have been performing lately I doubt we will see rates drop below $1.50.

If the FED decline to take action this week it is only a matter of time until they do. For this reason if you are looking to purchase dollars it is certainly worth considering taking advantage of the gains we have seen in the last month. GBP/USD has gained over 5.5% in the last six weeks, and to put the movement into monetary terms a £200.000 trade will now see you receive around $17,000 dollars more compared to the same trade secured on the 2nd August. Even if you don't need the funds straight away I have a number of currency contracts at my disposal that will help you take advantage of the current levels.

For more information on the contracts I can offer or to discuss the current market prices use the link below and complete the contact form for a free, no-obligation consultation.

Click here to complete the contact form

Wednesday 11 September 2013

GBP/USD exchange rates hit eight month high

Good afternoon,

GBP/USD exchange rates jumped to the highest levels since early February this morning following stronger than forecast UK unemployment figures. Rates increased from $1.5720 to reach a high of $1.5811 taking sterling gains against the dollar to 4.65% in just over a month. To put the improvement into monetary terms, a £200,000 trade will now see you receive around $14,000 more compared to the same trade booked on the 2nd August. For more information on live market prices click here.

The UK economy continued on its recent upward trend today after better than expected unemployment numbers. Since the Bank of England announced they would not look to amend interest rates until unemployment in the UK reaches 7% market players are now paying extra attention to the monthly unemployment figures. It had been forecast there would be no change to the current level of 7.8% but with the data release showing unemployment had fallen to 7.7% the pound quickly strengthened pushing GBP/USD to a fresh high.

For the best rates of exchange click here.

There was more good news as an unexpected drop in the number of people claiming Job-Seekers Allowance helped boost Sterling's performance. Official figures showed 32,600 fewer people are now claiming unemployment benefits compared to last month and are another indication that the UK economy is on the road to recovery.

So what does the future hold?

Unfortunately no one has a crystal ball but the pound is certainly in a stronger position compared to a month ago. If the UK continues to improve we could well see GBP/USD exchange rates push close to $1.60, although how long that will last will depend on when the U.S Federal Reserve start to wind down their current bond buying programme.

With the Federal Open Market Committee (FOMC) due to make a statement next week there is a chance we may get an indication to when tapering may begin which is likely to cause some market volatility in the build up to the announcement.

I have said a few times in recent weeks that once we know when tapering will start the dollar will start to strengthen, wiping out some of recent gains. How far it will drive down exchange rates is anyone's guess but with GBP/USD currently sitting at an eight month high it is certainly a good time to buy dollars and secure your rate of exchange.

If you would like more information on how I can help and the rates of exchange I can offer, click on the link below and complete the contact form for a free, no-obligation consultation.

Click here to complete the contact form

GBP/USD exchange rates jumped to the highest levels since early February this morning following stronger than forecast UK unemployment figures. Rates increased from $1.5720 to reach a high of $1.5811 taking sterling gains against the dollar to 4.65% in just over a month. To put the improvement into monetary terms, a £200,000 trade will now see you receive around $14,000 more compared to the same trade booked on the 2nd August. For more information on live market prices click here.

The UK economy continued on its recent upward trend today after better than expected unemployment numbers. Since the Bank of England announced they would not look to amend interest rates until unemployment in the UK reaches 7% market players are now paying extra attention to the monthly unemployment figures. It had been forecast there would be no change to the current level of 7.8% but with the data release showing unemployment had fallen to 7.7% the pound quickly strengthened pushing GBP/USD to a fresh high.

For the best rates of exchange click here.

There was more good news as an unexpected drop in the number of people claiming Job-Seekers Allowance helped boost Sterling's performance. Official figures showed 32,600 fewer people are now claiming unemployment benefits compared to last month and are another indication that the UK economy is on the road to recovery.

So what does the future hold?

Unfortunately no one has a crystal ball but the pound is certainly in a stronger position compared to a month ago. If the UK continues to improve we could well see GBP/USD exchange rates push close to $1.60, although how long that will last will depend on when the U.S Federal Reserve start to wind down their current bond buying programme.

With the Federal Open Market Committee (FOMC) due to make a statement next week there is a chance we may get an indication to when tapering may begin which is likely to cause some market volatility in the build up to the announcement.

I have said a few times in recent weeks that once we know when tapering will start the dollar will start to strengthen, wiping out some of recent gains. How far it will drive down exchange rates is anyone's guess but with GBP/USD currently sitting at an eight month high it is certainly a good time to buy dollars and secure your rate of exchange.

If you would like more information on how I can help and the rates of exchange I can offer, click on the link below and complete the contact form for a free, no-obligation consultation.

Click here to complete the contact form

Thursday 5 September 2013

GBP/USD exhange start to fall

Good afternoon,

Sterling dropped almost a cent against the dollar this afternoon despite a run of positive data and no major surprises from the Bank of England (BoE) monthly meeting. The day started out well for the pound as the GBP/USD cross broke through $1.56 to reach a high of $1.5666. However, the gains were short lived as some positive news for the U.S and comments by ECB Chairman Mario Draghi saw the dollar recover to bring exchange rates back down to a low of $1.5576. For more information on live market prices click here.

After yesterdays excellent service sector figures, which saw the sector grow at it fasted pace for over six years, Sterling was in a strong position as BoE Governor Mark Carney and his fellow MPC members met for their monthly meeting. Since Mr Carney issued his forward guidance last month there was never a chance that interest rates would be changed and as expected this was the case. There was also no change to the existing Quantitative Easing programme and the news pushed the pound up by over half a point against the dollar to leave us close to the $1.57 mark we witnessed briefly on the 21st August.

If you want the best exchange rate for your transfer click here.

As I have already mentioned though the gains did not last for very long. U.S unemployment figures released this afternoon came in better than forecast with 9000 fewer people now filing for

unemployment and coupled with Mario Draghi saying that interest rates in the Eurozone will remain at their current level or lower for an extended period the dollar managed to claw back the ground it lost over trading this morning.

All eyes will now turn to tomorrow and the U.S non-farm payroll numbers. This will show us how many jobs were created in the States during August and a positive reading could add to speculation that the U.S Federal Reserve will look to begin tapering sooner rather than later. A positive reading tomorrow will immediately strengthen the dollar and push exchange rates lower, it is forecast that 177K jobs were created last month but if the actual figures comes in closer to 200K then I would not be surprised to see GBP/USD exchange rates drop back towards $1.5450.

If you need to buy or sell dollars in the coming months and would like to make the most from your currency transfer, use the link below and complete the contact form for a free no-obligation consultation.

Click here to complete the contact form.

Sterling dropped almost a cent against the dollar this afternoon despite a run of positive data and no major surprises from the Bank of England (BoE) monthly meeting. The day started out well for the pound as the GBP/USD cross broke through $1.56 to reach a high of $1.5666. However, the gains were short lived as some positive news for the U.S and comments by ECB Chairman Mario Draghi saw the dollar recover to bring exchange rates back down to a low of $1.5576. For more information on live market prices click here.

After yesterdays excellent service sector figures, which saw the sector grow at it fasted pace for over six years, Sterling was in a strong position as BoE Governor Mark Carney and his fellow MPC members met for their monthly meeting. Since Mr Carney issued his forward guidance last month there was never a chance that interest rates would be changed and as expected this was the case. There was also no change to the existing Quantitative Easing programme and the news pushed the pound up by over half a point against the dollar to leave us close to the $1.57 mark we witnessed briefly on the 21st August.

If you want the best exchange rate for your transfer click here.

As I have already mentioned though the gains did not last for very long. U.S unemployment figures released this afternoon came in better than forecast with 9000 fewer people now filing for

unemployment and coupled with Mario Draghi saying that interest rates in the Eurozone will remain at their current level or lower for an extended period the dollar managed to claw back the ground it lost over trading this morning.

All eyes will now turn to tomorrow and the U.S non-farm payroll numbers. This will show us how many jobs were created in the States during August and a positive reading could add to speculation that the U.S Federal Reserve will look to begin tapering sooner rather than later. A positive reading tomorrow will immediately strengthen the dollar and push exchange rates lower, it is forecast that 177K jobs were created last month but if the actual figures comes in closer to 200K then I would not be surprised to see GBP/USD exchange rates drop back towards $1.5450.

If you need to buy or sell dollars in the coming months and would like to make the most from your currency transfer, use the link below and complete the contact form for a free no-obligation consultation.

Click here to complete the contact form.

Monday 2 September 2013

GBP/USD exchange rate update

Good afternoon,

Sterling gained almost a cent against the dollar during trading today following better than expected UK Manufacturing figures. GBP/USD exchange rates reached a high of $1.5589 following the data release before dropping around 20 pips towards the end of the afternoon. For more information on live market prices and the exchange rates I can offer click here.

Figures released this morning showed the UK manufacturing sector had grown for a fifth consecutive month. The Markit/CIPS purchasing managers' index (PMI) climbed to 57.2 when it had been forecast we would only see a small rise on last months figure of 54.8 (a score over 50 indicates growth).

The data had an immediate impact on the currency markets as the pounds value increased across the board, Sterling-dollar jumped from $1.5543 to $1.5589 to reclaim some of the ground lost towards the end of last week.

So what can we expect this week?

It is quite an important week in terms of data releases for the UK and U.S which in turn is expected to cause some volatility in the FX markets. On Thursday the Bank of England will hold there monthly meeting to discuss their monetary policy. Due to the Forward Guidance that was issued a few weeks ago it is safe to say we will not see any changes to interest rates. What will be key is to see if there is any mention of more Quantitative Easing, it is highly unlikely we will see the central bank add to the current programme on Thursday but if there is any mention of adding to the £375 billion which has already been pumped into the UK economy in the near future we could see the pound lose a bit of momentum.

For commercial rates of exchange click here

On Friday the U.S will release their latest non-farm payroll figures which will show how many jobs were created in August. The numbers will be closely watched as the U.S Federal Reserve are looking for improvements in the Job sector before they begin to taper their huge stimulus programme. If the figures come in well above the predicted number we can expect the dollar to immediately strengthen which will drive down GBP/USD exchange rates. It will also add to the speculation that the tapering will begin sooner rather than later which again will give the dollar extra support.

As I have said on countless occasions the gains we have seen for Sterling in recent weeks could well be short lived. As soon as Mr Bernanke gives the go ahead to scale back the bond buying scheme the dollars value will increase making it more expensive to buy. If the job numbers are positive on Friday I would not be surprised to see GBP/USD fall by over 1% and once the tapering begins a drop back towards $1.50 is not off of the cards.

If you need to buy or sell dollars in the coming months and would like to make the most from your currency transfer, use the link below and complete the contact form for a free, no-obligation consultation.

Click here to complete the contact form

Sterling gained almost a cent against the dollar during trading today following better than expected UK Manufacturing figures. GBP/USD exchange rates reached a high of $1.5589 following the data release before dropping around 20 pips towards the end of the afternoon. For more information on live market prices and the exchange rates I can offer click here.

Figures released this morning showed the UK manufacturing sector had grown for a fifth consecutive month. The Markit/CIPS purchasing managers' index (PMI) climbed to 57.2 when it had been forecast we would only see a small rise on last months figure of 54.8 (a score over 50 indicates growth).

The data had an immediate impact on the currency markets as the pounds value increased across the board, Sterling-dollar jumped from $1.5543 to $1.5589 to reclaim some of the ground lost towards the end of last week.

So what can we expect this week?

It is quite an important week in terms of data releases for the UK and U.S which in turn is expected to cause some volatility in the FX markets. On Thursday the Bank of England will hold there monthly meeting to discuss their monetary policy. Due to the Forward Guidance that was issued a few weeks ago it is safe to say we will not see any changes to interest rates. What will be key is to see if there is any mention of more Quantitative Easing, it is highly unlikely we will see the central bank add to the current programme on Thursday but if there is any mention of adding to the £375 billion which has already been pumped into the UK economy in the near future we could see the pound lose a bit of momentum.

For commercial rates of exchange click here

On Friday the U.S will release their latest non-farm payroll figures which will show how many jobs were created in August. The numbers will be closely watched as the U.S Federal Reserve are looking for improvements in the Job sector before they begin to taper their huge stimulus programme. If the figures come in well above the predicted number we can expect the dollar to immediately strengthen which will drive down GBP/USD exchange rates. It will also add to the speculation that the tapering will begin sooner rather than later which again will give the dollar extra support.

As I have said on countless occasions the gains we have seen for Sterling in recent weeks could well be short lived. As soon as Mr Bernanke gives the go ahead to scale back the bond buying scheme the dollars value will increase making it more expensive to buy. If the job numbers are positive on Friday I would not be surprised to see GBP/USD fall by over 1% and once the tapering begins a drop back towards $1.50 is not off of the cards.

If you need to buy or sell dollars in the coming months and would like to make the most from your currency transfer, use the link below and complete the contact form for a free, no-obligation consultation.

Click here to complete the contact form

Subscribe to:

Posts (Atom)