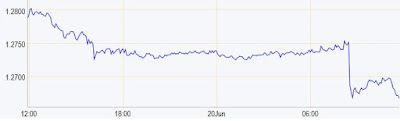

The pound rose almost two cents against the dollar today, with the GBP/USD cross rising from $1.2797 to $1.2969 and leaves the currency pair at its highest level since the 25th May.

The pound rose almost two cents against the dollar today, with the GBP/USD cross rising from $1.2797 to $1.2969 and leaves the currency pair at its highest level since the 25th May. For the best dollar exchange rates click here.

Sterling rose across the board as a result of comments made by Bank of England (BoE) Governor Mark Carney this afternoon.

His comments related to a potential interest rate hike in the UK and an apparent change in stance from the BoE Chief. Only last week Mr Carney poured cold water over the recent Bank of England rate vote (when three members of the policy committee voted in favour of an immediate rise) by saying that now is not the time to start hiking rates.

However, this afternoon Carney said some removal of monetary stimulus could soon become necessary, essentially saying the central bank could soon raise interest rates and the news gave the pound a much needed boost.

GBP/USD graph

Are you looking to buy or sell dollars?

If you have a requirement to buy or sell dollars in the coming months and want to ensure you are making the most from your currency transfer, contact us today for a free currency consultation.

As specialists in currency exchange we have a range of tools available to help protect you against adverse market movements, or target a rate that might not be currently available.

We also offer significantly better exchange rates than high street banks offer, meaning you could save thousands on your currency exchange.