Looking for the best GBP/USD exchange rate?

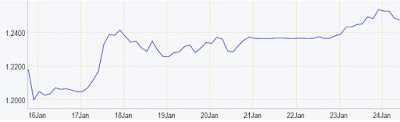

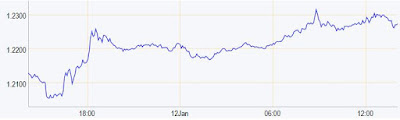

GBP/USD has risen over a cent and a half today, despite the UK posting weaker than forecast consumer credit figures. Figures released by the Bank of England confirmed that consumers had slowed the pace of their borrowing in December, the first decline for nearly five months and caused the pound/dollar exchange rate to fall from $1.25 to $1.2425.

However, sterling's fortunes quickly changed as the dollar began to lose ground just before midday, after an advisor to President Trump added to speculation the new administration are attempting to devalue its currency.

Comments by the head of the National Trade Council Peter Navarro, suggested that Germany were benefiting from a undervalued euro and that they were exploiting their trading partners, and that the euro was a German currency in disguise.

As you can see from the graph below the dollar immediately started to fall as the news broke, with GBP/USD rising to an intraday high of $1.2586.

GBP/USD graph.

Do you need to buy or sell dollars?

If you are looking to buy or sell dollars in the weeks and want to make sure are making the most from your transfer, contact me today for a free, no-obligation currency consultation.

As a specialist in currency exchange I have a range of tools at my disposal to help protect you against adverse market movements or target a rate of exchange that might not be currently available.

For more information about how I can help or to find out what rate of exchange I can offer, complete the contact form by click on the link below.

As a specialist in currency exchange I have a range of tools at my disposal to help protect you against adverse market movements or target a rate of exchange that might not be currently available.

For more information about how I can help or to find out what rate of exchange I can offer, complete the contact form by click on the link below.