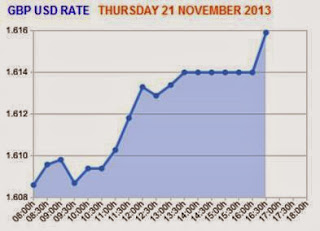

Since yesterdays post there has been quite a swing with the GBP/USD cross, after I mentioned Sterling/dollar was at its highest level for nearly a month, trading opened this morning with the exchange rate over a cent down and sitting at $1.6073. Reports the FED would look to start tapering in the coming months caused the dollar to strengthen, however, as markets opened this morning the greenback was unable to hold onto the gains as the pound clawed back the ground it had lost over the course of the day.

For a free, no-obligation currency consultation click here.

The day started well for the UK and the pound as the latest Public Net borrowing figures were released by the office of National Statistics. Although the number missed the predicted it is the third month running we have seen an improvement in the UK's finances.

For commercial rates of exchange click here.

The pound also rose against the dollar following Janet Yellen being nominated as the next FED chair by the U.S. Senate banking committee. She will now stand in front of the full Senate, but as the Senate is controlled by the Democrats it is now only a formality that she will take over from the current Chairman Ben Bernanke.

So why would Janet Yellen being nominated cause the dollar to weaken?

Although there have been calls for the Federal Reserve (FED) to start tapering sooner rather than later and yesterdays minutes documenting the FED want to start tapering in the coming months, it is still to be seen what action Janet Yellen will take.

This has left market players and investors uncertain as to how she plans to tackle the existing issues surrounding the U.S. economy as her views are more or less the same as the Mr Bernanke's.

Until we are given some clear guidelines by the FED I would expect exchange rates to continue being relatively choppy. If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below to complete the contact or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.