Good afternoon,

What a day for the Pound! After this mornings GDP estimate, Sterling found some momentum against the U.S. dollar to reach its highest level since early January. Trade opened today with GBP/USD sitting just over $1.62, but a gain of nearly 0.75% pushed exchange rates up to $1.6330 by early afternoon.

For a free currency consultation click here.

This morning saw the Office of National Statistics release its second GDP estimate for Q3 and with the figure falling in line with initial estimates. The report confirmed the UK economy has expanded by 0.8% which highlights once again the UK recovery is picking up speed.

Want to know when your target rate is available??? Click here

It wasn't only against the dollar that the pound rose. Sterling gained strength against all of the major currencies and once again briefly broke €1.20 against the euro.

However, with better than expected U.S. unemployment claims GBP/USD was unable to stay over $1.63. It was forecast there would be a rise in the number of people claiming for unemployment but with a reduction of 15,000 the greenback was able to claw back some lost ground and at the time of writing cable was down to $1.6265.

Today's movement shows just how volatile the FX markets can be, to put the movements into monetary terms a £200,000 trade into dollars would have varied by around $2,400 between the low and the high of the day.

It also shows just how important it is to get the timing right on your currency transfer. So if you need to buy or sell dollars in the coming weeks and want to ensure you are making the most of your money, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Market Reports published by Senior Currency Broker Arron Morris, forecasts and data that can impact pound/dollar exchange rates. Used by those that need to buy or sell U.S Dollars at commercial exchange rates. Our rates are better than those available at banks or other financial institutions, so contact me today to see how much you can save on your currency transaction.

Wednesday, 27 November 2013

Monday, 25 November 2013

GBP/USD falls to one month low

Good afternoon,

GBP/USD exchange rates fell today after weaker than expected UK mortgage numbers. Trading opened this morning with the Sterling/dollar cross sitting just below $1.6225 but the negative data caused rates to drop throughout the day to a low of $1.6134. Todays decline has left exchange rates at their lowest level for nearly a month and with little data out of the UK this week, the pounds performance looks likely to be determined by events elsewhere.

For a free currency consultation click here.

Figures released this morning by the British Bankers Association showed the number of mortgages taken out in October had fallen slightly compared to Septembers numbers. There were 42,808 new loans approved last month, a fall of only 375, but despite only a very small decline there was a relatively large impact on the pounds performance.

What can we expect this week?

As I have already mentioned there is not much to get excited about in terms of data releases from the UK, the only data of any real note will come on Wednesday when the Office of National Statistics release second Gross Domestic Product (GDP) estimate for quarter three. Any change from the first estimate and Wednesdays forecast reading of 0.8% could cause some sudden movements for the GDP/USD cross.

For commercial rates of exchange click here.

There are a few more releases over in the states this week which could impact the dollars value. Building permits and Consumer confidence numbers are due to be released on Tuesday, with Core durable good orders and Unemployment claims being released on Wednesday.

The U.S. economy is being closely watched at the moment and any improvements will add to speculation that the Federal Reserve could soon start to wind down its $85 billion monthly asset purchasing programme.

I will keep you updated throughout the week of how exchange rates are performing, but in the meantime if you have a requirement to buy or sell dollars and want to ensure you are making the most of your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

GBP/USD exchange rates fell today after weaker than expected UK mortgage numbers. Trading opened this morning with the Sterling/dollar cross sitting just below $1.6225 but the negative data caused rates to drop throughout the day to a low of $1.6134. Todays decline has left exchange rates at their lowest level for nearly a month and with little data out of the UK this week, the pounds performance looks likely to be determined by events elsewhere.

For a free currency consultation click here.

Figures released this morning by the British Bankers Association showed the number of mortgages taken out in October had fallen slightly compared to Septembers numbers. There were 42,808 new loans approved last month, a fall of only 375, but despite only a very small decline there was a relatively large impact on the pounds performance.

What can we expect this week?

As I have already mentioned there is not much to get excited about in terms of data releases from the UK, the only data of any real note will come on Wednesday when the Office of National Statistics release second Gross Domestic Product (GDP) estimate for quarter three. Any change from the first estimate and Wednesdays forecast reading of 0.8% could cause some sudden movements for the GDP/USD cross.

For commercial rates of exchange click here.

There are a few more releases over in the states this week which could impact the dollars value. Building permits and Consumer confidence numbers are due to be released on Tuesday, with Core durable good orders and Unemployment claims being released on Wednesday.

The U.S. economy is being closely watched at the moment and any improvements will add to speculation that the Federal Reserve could soon start to wind down its $85 billion monthly asset purchasing programme.

I will keep you updated throughout the week of how exchange rates are performing, but in the meantime if you have a requirement to buy or sell dollars and want to ensure you are making the most of your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Thursday, 21 November 2013

GBP/USD exchange rates recover

Good afternoon,

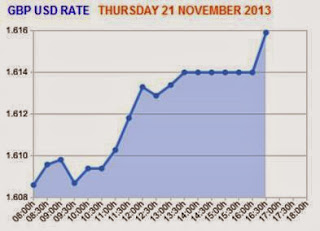

Since yesterdays post there has been quite a swing with the GBP/USD cross, after I mentioned Sterling/dollar was at its highest level for nearly a month, trading opened this morning with the exchange rate over a cent down and sitting at $1.6073. Reports the FED would look to start tapering in the coming months caused the dollar to strengthen, however, as markets opened this morning the greenback was unable to hold onto the gains as the pound clawed back the ground it had lost over the course of the day.

For a free, no-obligation currency consultation click here.

The day started well for the UK and the pound as the latest Public Net borrowing figures were released by the office of National Statistics. Although the number missed the predicted it is the third month running we have seen an improvement in the UK's finances.

For commercial rates of exchange click here.

The pound also rose against the dollar following Janet Yellen being nominated as the next FED chair by the U.S. Senate banking committee. She will now stand in front of the full Senate, but as the Senate is controlled by the Democrats it is now only a formality that she will take over from the current Chairman Ben Bernanke.

So why would Janet Yellen being nominated cause the dollar to weaken?

Although there have been calls for the Federal Reserve (FED) to start tapering sooner rather than later and yesterdays minutes documenting the FED want to start tapering in the coming months, it is still to be seen what action Janet Yellen will take.

She is thought to be very dovish when it comes to economic policy, which essentially means she is happy with the way the U.S. government are currently spending and the existing stimulus measures the FED are undertaking.

This has left market players and investors uncertain as to how she plans to tackle the existing issues surrounding the U.S. economy as her views are more or less the same as the Mr Bernanke's.

Until we are given some clear guidelines by the FED I would expect exchange rates to continue being relatively choppy. If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below to complete the contact or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Since yesterdays post there has been quite a swing with the GBP/USD cross, after I mentioned Sterling/dollar was at its highest level for nearly a month, trading opened this morning with the exchange rate over a cent down and sitting at $1.6073. Reports the FED would look to start tapering in the coming months caused the dollar to strengthen, however, as markets opened this morning the greenback was unable to hold onto the gains as the pound clawed back the ground it had lost over the course of the day.

For a free, no-obligation currency consultation click here.

The day started well for the UK and the pound as the latest Public Net borrowing figures were released by the office of National Statistics. Although the number missed the predicted it is the third month running we have seen an improvement in the UK's finances.

For commercial rates of exchange click here.

The pound also rose against the dollar following Janet Yellen being nominated as the next FED chair by the U.S. Senate banking committee. She will now stand in front of the full Senate, but as the Senate is controlled by the Democrats it is now only a formality that she will take over from the current Chairman Ben Bernanke.

So why would Janet Yellen being nominated cause the dollar to weaken?

Although there have been calls for the Federal Reserve (FED) to start tapering sooner rather than later and yesterdays minutes documenting the FED want to start tapering in the coming months, it is still to be seen what action Janet Yellen will take.

This has left market players and investors uncertain as to how she plans to tackle the existing issues surrounding the U.S. economy as her views are more or less the same as the Mr Bernanke's.

Until we are given some clear guidelines by the FED I would expect exchange rates to continue being relatively choppy. If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below to complete the contact or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Wednesday, 20 November 2013

GBP/USD exchange rates highest since 28th October

Good afternoon,

The pound rose against the dollar today after the Bank of England (BoE) released the minutes from its meeting at the start of November and the U.S posted some weaker than forecast numbers. Trading opened with GBP/USD exchange rates sitting just above $1.61 but over the course of the day rates gradually climbed to reach a high of $1.6177.

For a free currency consultation click here.

There was more positive news for the UK and the pound today as the minutes from Novembers Monetary Policy Committees (MPC) meeting revealed all nine members voted in favour of keeping the existing Quantitative Easing (QE) programme on hold and to keep interest rates at 0.5%.

The minutes also went on to show the committee believe that the UK recovery is taking shape and is not facing any major risks of inflation. Sterling immediately benefited from the news and pushed exchange rates towards $1.6050 for the first time since 28th October.

For commercial rates of exchange click here

The gains did not stop there as weaker than forecast Existing Home Sales and Consumer Price Index (CPI) data from the U.S caused the dollar to weaken in the afternoon taking the GBP/USD cross to a high of $1.6177.

Will the gains continue?

It will all depend on how the UK and U.S. economies continue to perform. The UK seems to be heading in the right direction and until the U.S. Federal Reserve sees sustained improvement in the U.S. economy it is unlikely we will see them start to cut back their current QE programme. The $85 billion the FED are pumping into the economy is one of the major reasons we have seen the dollar weaken during 2013. However, it is a matter of when not if until the FED do start to taper and once that happens I would expect the dollar to quickly recover some of the ground it has lost to the pound and euro over the past few months.

Until that time I am sure the volatility we have seen in the FX market over the last couple of weeks will continue. If you have a requirement to buy or sell dollars and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form

The pound rose against the dollar today after the Bank of England (BoE) released the minutes from its meeting at the start of November and the U.S posted some weaker than forecast numbers. Trading opened with GBP/USD exchange rates sitting just above $1.61 but over the course of the day rates gradually climbed to reach a high of $1.6177.

For a free currency consultation click here.

There was more positive news for the UK and the pound today as the minutes from Novembers Monetary Policy Committees (MPC) meeting revealed all nine members voted in favour of keeping the existing Quantitative Easing (QE) programme on hold and to keep interest rates at 0.5%.

The minutes also went on to show the committee believe that the UK recovery is taking shape and is not facing any major risks of inflation. Sterling immediately benefited from the news and pushed exchange rates towards $1.6050 for the first time since 28th October.

For commercial rates of exchange click here

The gains did not stop there as weaker than forecast Existing Home Sales and Consumer Price Index (CPI) data from the U.S caused the dollar to weaken in the afternoon taking the GBP/USD cross to a high of $1.6177.

Will the gains continue?

It will all depend on how the UK and U.S. economies continue to perform. The UK seems to be heading in the right direction and until the U.S. Federal Reserve sees sustained improvement in the U.S. economy it is unlikely we will see them start to cut back their current QE programme. The $85 billion the FED are pumping into the economy is one of the major reasons we have seen the dollar weaken during 2013. However, it is a matter of when not if until the FED do start to taper and once that happens I would expect the dollar to quickly recover some of the ground it has lost to the pound and euro over the past few months.

Until that time I am sure the volatility we have seen in the FX market over the last couple of weeks will continue. If you have a requirement to buy or sell dollars and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form

Monday, 18 November 2013

Pound/dollar exchange rate update

Good afternoon,

With no data coming out of the UK today, Sterling was at the mercy of events elsewhere and with nothing to support the pound the GBP/USD cross fell by over half a point. Trade opened this morning with exchange rates sitting at a high of $1.6147 but over the course of the day rates continuously dropped to reach a low of $1.6094.

For a free currency consultation click here.

What can we expect for Sterling/dollar?

It has been a turbulent few days for GBP/USD, in the last week we have seen rates as low as $1.5869 before recovering to reach $1.6150 (a gain of 1.75%). It looks as though the UK recovery is now firmly on track and with Mark Carney and the Bank of England raising the growth forecast for 2013 and 2014, Sterling was able to find some much needed support.

For commercial rates of exchange click here.

If the UK economy continues to perform well there is every chance we could see rates continue to rise which will be great news for anyone looking to purchase dollars, in fact, one of the forecasts I received this morning indicated we could see rates reach $1.64 within the next couple of weeks.

I personally think this is a little unrealistic as even when the U.S were close to reaching their debt ceiling exchange rates only just got over $1.62. If the U.S continues to under perform and the UK has a run of positive data we could see rates push towards a 2013 high but that would only just take us over $1.63.

However, lets not get to carried away! There have been reports in the last week that the U.S Federal Reserve could bring tapering to the table as early as December. If the FED were to look at reducing their extravagant bond buying programme from $85 billion dollars a month, there is every change we will see the dollar quickly strengthen which is likely to bring rates back below $1.60.

I think the next few weeks will continue to be pretty volatile for Sterling and the dollar, so if you have a requirement to buy or sell currency in the coming weeks it is important to know what tools are available to help you make the most form your transfer. Use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

With no data coming out of the UK today, Sterling was at the mercy of events elsewhere and with nothing to support the pound the GBP/USD cross fell by over half a point. Trade opened this morning with exchange rates sitting at a high of $1.6147 but over the course of the day rates continuously dropped to reach a low of $1.6094.

For a free currency consultation click here.

What can we expect for Sterling/dollar?

It has been a turbulent few days for GBP/USD, in the last week we have seen rates as low as $1.5869 before recovering to reach $1.6150 (a gain of 1.75%). It looks as though the UK recovery is now firmly on track and with Mark Carney and the Bank of England raising the growth forecast for 2013 and 2014, Sterling was able to find some much needed support.

For commercial rates of exchange click here.

If the UK economy continues to perform well there is every chance we could see rates continue to rise which will be great news for anyone looking to purchase dollars, in fact, one of the forecasts I received this morning indicated we could see rates reach $1.64 within the next couple of weeks.

I personally think this is a little unrealistic as even when the U.S were close to reaching their debt ceiling exchange rates only just got over $1.62. If the U.S continues to under perform and the UK has a run of positive data we could see rates push towards a 2013 high but that would only just take us over $1.63.

However, lets not get to carried away! There have been reports in the last week that the U.S Federal Reserve could bring tapering to the table as early as December. If the FED were to look at reducing their extravagant bond buying programme from $85 billion dollars a month, there is every change we will see the dollar quickly strengthen which is likely to bring rates back below $1.60.

I think the next few weeks will continue to be pretty volatile for Sterling and the dollar, so if you have a requirement to buy or sell currency in the coming weeks it is important to know what tools are available to help you make the most form your transfer. Use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Subscribe to:

Comments (Atom)