Good afternoon,

After what seems like a brief recovery, Sterling lost further ground against the dollar today as exchange rates once again slipped back below $1.63. When I arrived at the office this morning GBP/USD exchange rates we sitting close to $1.6330 but after some weak economic data from the UK and some positive numbers from the States the pound continued to slide against the improving dollar. At the time of writing GBP/USD had fallen by over a cent to reach a low of $1.6225.

For a free currency consultation click here.

Todays decline means the pound has lost nearly 1.35% against the dollar in just over a week. It might not sound very much but in monetary terms it can make a massive difference. If you were converting £250,000 into dollars today, the drop in exchange rates would mean you receive almost $5,700 less compared to the same trade secured at last weeks high.

Want to know when your preferred rate is available?? click here.

The positive data releases that came out of the States this afternoon will fuel speculation that the U.S. economy is starting recover. If the economy is seen to be improving it could also heighten expectations the U.S Federal Reserve will start to cut back their on-going stimulus package. With FED officials currently holding a meeting there is an outside chance we may get an idea of there tapering plans as early as tomorrow.

I think it is unlikely that tapering will being tomorrow, but if the FED come out and say they will look to start reducing the amount they injecting into the economy in January, the dollar could quickly start to gain momentum against most of its major counterparts.

If you are thinking of buying or selling dollars in the coming weeks and would like to take the element of doubt and risk out of your currency transfer, there are a number of tools I have at my disposal to help you make the most from your money. Use the link below or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Market Reports published by Senior Currency Broker Arron Morris, forecasts and data that can impact pound/dollar exchange rates. Used by those that need to buy or sell U.S Dollars at commercial exchange rates. Our rates are better than those available at banks or other financial institutions, so contact me today to see how much you can save on your currency transaction.

Tuesday, 17 December 2013

Friday, 13 December 2013

GBP/USD exchange rate update

Good afternoon,

Sterling lost more ground against the dollar today (Friday) to bring an end to a disappointing week. The decline in exchange rates means the pound lost around 1.2% against the greenback since the highs we witnessed at the start of the week.

From Tuesdays high of $1.6463 cable fell to a low of $1.6266 by Friday afternoon, the first time the GBP/USD cross has dipped below $1.63 since 27th November.

For a free currency consultation click here.

So what does this mean in monetary terms?

To put the move into perspective a £200,000 trade will now see you receive around $3,950 dollars less compared to the same trade secured at Tuesdays high.

Should I wait for the rate to move back up to $1.64?

It is a risky business waiting to see if the markets move in your favour. For those that are thinking of buying dollars and missed the chance to take advantage of the weeks high, it is still an excellent time to think about converting your funds.

Want to know when your preferred rate is available??? click here.

Exchange rates are still 10% higher than earlier in the year and with the increasing prospect that the U.S. Federal Reserve (FED) will start to cut back their stimulus package as early as next week, we could see exchange rates fall even further.

If FED chairman Ben Bernanke does opt to start tapering next week then we should start to see the dollar strengthen as soon as an announcement is made. How far rates would fall would depend how much is trimmed off the current $85 billion per month payment, but if exchange rates are still sitting around their current level we could easily see the cross drop back below $1.60.

If you need to buy or sell dollars in the coming weeks and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Sterling lost more ground against the dollar today (Friday) to bring an end to a disappointing week. The decline in exchange rates means the pound lost around 1.2% against the greenback since the highs we witnessed at the start of the week.

From Tuesdays high of $1.6463 cable fell to a low of $1.6266 by Friday afternoon, the first time the GBP/USD cross has dipped below $1.63 since 27th November.

For a free currency consultation click here.

So what does this mean in monetary terms?

To put the move into perspective a £200,000 trade will now see you receive around $3,950 dollars less compared to the same trade secured at Tuesdays high.

Should I wait for the rate to move back up to $1.64?

It is a risky business waiting to see if the markets move in your favour. For those that are thinking of buying dollars and missed the chance to take advantage of the weeks high, it is still an excellent time to think about converting your funds.

Want to know when your preferred rate is available??? click here.

Exchange rates are still 10% higher than earlier in the year and with the increasing prospect that the U.S. Federal Reserve (FED) will start to cut back their stimulus package as early as next week, we could see exchange rates fall even further.

If FED chairman Ben Bernanke does opt to start tapering next week then we should start to see the dollar strengthen as soon as an announcement is made. How far rates would fall would depend how much is trimmed off the current $85 billion per month payment, but if exchange rates are still sitting around their current level we could easily see the cross drop back below $1.60.

If you need to buy or sell dollars in the coming weeks and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Wednesday, 11 December 2013

Dollar starts to gain against the pound

Good afternoon,

GBP/USD exchange rates fell away from their recent highs as U.S government officials agreed to ease spending cuts and reduce their ever growing budget deficit. Sterling lost over a cent against the dollar falling from $1.6464 to a low $1.6324 before recovering back towards $1.64 at the time of writing.

For more information on live market prices click here.

The agreement reached by U.S. officials yesterday (Tuesday) is a big boost to the American economy, as it greatly reduces the risk of another government shutdown and a potential breach of the debt ceiling when the existing deal expires in February.

It also adds to speculation the Federal Reserve could look to start cutting back its $85 billion stimulus programme as early as December. This could be a major breakthrough for the dollar which has lost so much ground against most of its major counterparts in recent times.

Want to know when you preferred rates is available?? click here.

All eyes will now be firmly on the FED meeting next week and it could be the perfect Christmas present for those looking to sell dollars. With exchange rates moving against them for the last 4 months, there is now a real possibility we could see GBP/USD drop below $1.60 for the first time since mid-November.

The next week could see some real swings in the FX markets, especially in the run up to the FED meeting. Remember, exchange rates move on rumours just as much as fact, so as tongues start to wag and we get closer to the meeting I would expect to see big movements in cables performance.

If you have a requirement to buy or sell dollars now is the time to get in touch. If you are buying, it worth considering a forward contract to secure your rate close to the two year high, if selling a limit order could help you target a rate that is not currently available.

For more information use the link below to complete the contact form or contact me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

GBP/USD exchange rates fell away from their recent highs as U.S government officials agreed to ease spending cuts and reduce their ever growing budget deficit. Sterling lost over a cent against the dollar falling from $1.6464 to a low $1.6324 before recovering back towards $1.64 at the time of writing.

For more information on live market prices click here.

The agreement reached by U.S. officials yesterday (Tuesday) is a big boost to the American economy, as it greatly reduces the risk of another government shutdown and a potential breach of the debt ceiling when the existing deal expires in February.

It also adds to speculation the Federal Reserve could look to start cutting back its $85 billion stimulus programme as early as December. This could be a major breakthrough for the dollar which has lost so much ground against most of its major counterparts in recent times.

Want to know when you preferred rates is available?? click here.

All eyes will now be firmly on the FED meeting next week and it could be the perfect Christmas present for those looking to sell dollars. With exchange rates moving against them for the last 4 months, there is now a real possibility we could see GBP/USD drop below $1.60 for the first time since mid-November.

The next week could see some real swings in the FX markets, especially in the run up to the FED meeting. Remember, exchange rates move on rumours just as much as fact, so as tongues start to wag and we get closer to the meeting I would expect to see big movements in cables performance.

If you have a requirement to buy or sell dollars now is the time to get in touch. If you are buying, it worth considering a forward contract to secure your rate close to the two year high, if selling a limit order could help you target a rate that is not currently available.

For more information use the link below to complete the contact form or contact me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Monday, 9 December 2013

GBP/USD exchange rates break $1.64 again

Good afternoon,

Sterling has lost a bit of momentum since my lost post as rates dropped back below $1.6350 towards the end of last week. Trading today though has seen the pound claw back over half a per cent against the dollar, which has seen the GBP/USD cross break through $1.64.

For a free currency consultation click here.

In terms of data releases it has been a very slow day on both sides of the pond. Neither the UK or U.S produced any figures of note which left both Sterling and dollar at the mercy of events elsewhere. The pound faired well during early trading today as GBP/USD rates rose from $1.6320 to just below $1.6390 by mid-day and as the UK markets wound up business for the day cable pushed through $1.64 to reach a high of $1.6413.

Will rates continue to rise?

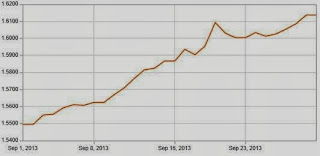

That question seems to be on everyone's tongue at the moment. Unfortunately I don't have a crystal ball but if we look at what has caused GBP/USD

to jump over 5% since September it is mainly down to dollar weakness. Yes the pound and the UK economy have been performing well but with all the issues that have come out of the United States in the last few months it is hardly surprising the dollars value has dropped so much.

Want to know when your preferred rate is available?? Click here.

However, speculation seems to be mounting that the U.S. Federal Reserve are on the brink of reducing its on-going stimulus package. Following Fridays positive job numbers and a reduction in the unemployment rate some market experts are predicting we could see tapering begin as early as 18th December. If that were to happen I would expect the dollar to instantly strengthen, what impact it has on exchange rates will depend on amount the stimulus package is reduced by.

If you are thinking of buying dollars it is certainly a good time to do so, even if you don't need the funds straight away you can secure your rate of exchange for up to two years into the future. For more information on how to take advantage of the current rate use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Sterling has lost a bit of momentum since my lost post as rates dropped back below $1.6350 towards the end of last week. Trading today though has seen the pound claw back over half a per cent against the dollar, which has seen the GBP/USD cross break through $1.64.

For a free currency consultation click here.

Will rates continue to rise?

That question seems to be on everyone's tongue at the moment. Unfortunately I don't have a crystal ball but if we look at what has caused GBP/USD

to jump over 5% since September it is mainly down to dollar weakness. Yes the pound and the UK economy have been performing well but with all the issues that have come out of the United States in the last few months it is hardly surprising the dollars value has dropped so much.

Want to know when your preferred rate is available?? Click here.

However, speculation seems to be mounting that the U.S. Federal Reserve are on the brink of reducing its on-going stimulus package. Following Fridays positive job numbers and a reduction in the unemployment rate some market experts are predicting we could see tapering begin as early as 18th December. If that were to happen I would expect the dollar to instantly strengthen, what impact it has on exchange rates will depend on amount the stimulus package is reduced by.

If you are thinking of buying dollars it is certainly a good time to do so, even if you don't need the funds straight away you can secure your rate of exchange for up to two years into the future. For more information on how to take advantage of the current rate use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Wednesday, 4 December 2013

GBP/USD exchange rates start to slide

Good afternoon,

The last 48 hours have been fairly volatile, which has seen GBP/USD exchange rates fluctuate by nearly a cent. Since my last post on Monday the pound has almost gone in a full circle, exchange rates moved from Mondays low of $1.6346 to a high of $1.6425 yesterday (Tuesday) before falling back to $1.6329 during trading today (Wednesday).

Todays post will take a quick look at why Sterling could not hold above $1.64 and what the rest of the week could hold for the GBP/USD cross.

For a free currency consultation click here.

Sterling was unable to maintain the gains it made against the dollar on Tuesday following some weaker than forecast UK Services PMI data and some better than expected numbers from the States.

Services PMI plays a major role in the UK economy as it gives a good indication of business conditions which include production, employment, new orders and prices. It was forecast we would see a score of 62.1 but with the actual number only coming in at 60.0 it meant things were not as great as everyone had hoped. The news caused Sterling to weaken almost immediately and after the States produced better than expected non-farm employment change and new home sales figures, GBP/USD fell to its lowest level since the 29th November ($1.6329).

Want to know when you preferred rate is available??? Click here.

The rest of the week is going to be interesting as Thursday and Friday will bring some of the most important reports and data releases for the month of December. The Bank of England will give their latest interest rate and monetary policy decision on tomorrow (Thursday). While across the pond we get the latest non-farm job numbers which nearly always cause some big movements in the FX market.

Rate Forecast

Now and again I like to keep you informed with what some of my brokers are thinking. This morning I received a very interesting email with a revised forecast. It was predicting GBP/USD exchange rates will be as low as $1.52 within the next 12 months.

This may seem a little hard to believe at the moment, especially considering how well the UK economy is performing., but what the forecast will be taking into account is the U.S Federal Reserve completely winding up their on-going stimulus package.

The dollar has lost a lot of ground against the pound and euro during 2013 but if the FED do start to cut back in the coming months should start to see the dollar recover, which in turn will see GBP/USD and EUR/USD rates start to retract.

If you are thinking of buying or selling dollars over the next few months and want to ensure you are making the most from you transfer, I have a number of tools available which can help. I can look at holding a current rate of exchange for up to two years or help you target a rate which might not be currently available. For more information use the link below and complete the contact form or call me directly on 01442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

The last 48 hours have been fairly volatile, which has seen GBP/USD exchange rates fluctuate by nearly a cent. Since my last post on Monday the pound has almost gone in a full circle, exchange rates moved from Mondays low of $1.6346 to a high of $1.6425 yesterday (Tuesday) before falling back to $1.6329 during trading today (Wednesday).

Todays post will take a quick look at why Sterling could not hold above $1.64 and what the rest of the week could hold for the GBP/USD cross.

For a free currency consultation click here.

Sterling was unable to maintain the gains it made against the dollar on Tuesday following some weaker than forecast UK Services PMI data and some better than expected numbers from the States.

Services PMI plays a major role in the UK economy as it gives a good indication of business conditions which include production, employment, new orders and prices. It was forecast we would see a score of 62.1 but with the actual number only coming in at 60.0 it meant things were not as great as everyone had hoped. The news caused Sterling to weaken almost immediately and after the States produced better than expected non-farm employment change and new home sales figures, GBP/USD fell to its lowest level since the 29th November ($1.6329).

Want to know when you preferred rate is available??? Click here.

The rest of the week is going to be interesting as Thursday and Friday will bring some of the most important reports and data releases for the month of December. The Bank of England will give their latest interest rate and monetary policy decision on tomorrow (Thursday). While across the pond we get the latest non-farm job numbers which nearly always cause some big movements in the FX market.

Rate Forecast

Now and again I like to keep you informed with what some of my brokers are thinking. This morning I received a very interesting email with a revised forecast. It was predicting GBP/USD exchange rates will be as low as $1.52 within the next 12 months.

This may seem a little hard to believe at the moment, especially considering how well the UK economy is performing., but what the forecast will be taking into account is the U.S Federal Reserve completely winding up their on-going stimulus package.

The dollar has lost a lot of ground against the pound and euro during 2013 but if the FED do start to cut back in the coming months should start to see the dollar recover, which in turn will see GBP/USD and EUR/USD rates start to retract.

If you are thinking of buying or selling dollars over the next few months and want to ensure you are making the most from you transfer, I have a number of tools available which can help. I can look at holding a current rate of exchange for up to two years or help you target a rate which might not be currently available. For more information use the link below and complete the contact form or call me directly on 01442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Monday, 2 December 2013

GBP/USD exchange rate update 02/12/2013

Good afternoon,

Since my last post Sterling has made some decent strides against the U.S dollar, over the weekend the GBP/USD cross reached its highest level for over two years as exchange rates pushed towards $1.6450.

For a free currency consultation click here

It looked as though rates may push even higher this morning, once again the UK underlined its status as the best performing Western economy in 2013, with the UK Manufacturing sector producing its strongest performance for almost 3 years.

We did initially see a brief rise after the data release (as the graph above shows) but Sterling was unable to hold onto the gains and started to run out of steam by mid-morning. At the time of writing exchange rates had fallen by nearly 0.5% and at its lowest left cable trading at $1.6346.

So why did rates starts to fall?

Todays move was not really down to Sterling weakness but dollar strength. Following a relatively quite few days in the States, largely due to Thanksgiving, the U.S. had a number of important data releases this afternoon and they did not disappoint.

The U.S. also released its latest Manufacturing numbers for November and just like the UK, had better than expected results. The Final Manufacturing PMI came in at 54.7it highest level for over 18 months, a number over 50 indicates growth in the sector.

Want me to inform you when your target rate is available? click here

What could move rates this week?

It could be a very volatile week for the GBP/USD cross with a number of highly important data releases due over the next few days.

From the UK we will see the latest retail sales numbers, Construction PMI and Services PMI. We will also get the latest figures from the Bank of England regarding interest rates and quantitative easing.

The U.S. will release their latest unemployment numbers, non-manufacturing PMI, preliminary GDP figures and on Friday the eagerly anticipated non-farm job numbers which normally cause some major swings in the FX market.

I will keep you updated over the course of the week about how the above moves exchanges rates but in the meantime if you are thinking of buying or selling dollars in the coming weeks and want to know how to make the most from your transfer, use the link below to complete the contact form all call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Since my last post Sterling has made some decent strides against the U.S dollar, over the weekend the GBP/USD cross reached its highest level for over two years as exchange rates pushed towards $1.6450.

For a free currency consultation click here

It looked as though rates may push even higher this morning, once again the UK underlined its status as the best performing Western economy in 2013, with the UK Manufacturing sector producing its strongest performance for almost 3 years.

We did initially see a brief rise after the data release (as the graph above shows) but Sterling was unable to hold onto the gains and started to run out of steam by mid-morning. At the time of writing exchange rates had fallen by nearly 0.5% and at its lowest left cable trading at $1.6346.

So why did rates starts to fall?

Todays move was not really down to Sterling weakness but dollar strength. Following a relatively quite few days in the States, largely due to Thanksgiving, the U.S. had a number of important data releases this afternoon and they did not disappoint.

The U.S. also released its latest Manufacturing numbers for November and just like the UK, had better than expected results. The Final Manufacturing PMI came in at 54.7it highest level for over 18 months, a number over 50 indicates growth in the sector.

Want me to inform you when your target rate is available? click here

What could move rates this week?

It could be a very volatile week for the GBP/USD cross with a number of highly important data releases due over the next few days.

From the UK we will see the latest retail sales numbers, Construction PMI and Services PMI. We will also get the latest figures from the Bank of England regarding interest rates and quantitative easing.

The U.S. will release their latest unemployment numbers, non-manufacturing PMI, preliminary GDP figures and on Friday the eagerly anticipated non-farm job numbers which normally cause some major swings in the FX market.

I will keep you updated over the course of the week about how the above moves exchanges rates but in the meantime if you are thinking of buying or selling dollars in the coming weeks and want to know how to make the most from your transfer, use the link below to complete the contact form all call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Wednesday, 27 November 2013

GBP/USD exchange rates rise again

Good afternoon,

What a day for the Pound! After this mornings GDP estimate, Sterling found some momentum against the U.S. dollar to reach its highest level since early January. Trade opened today with GBP/USD sitting just over $1.62, but a gain of nearly 0.75% pushed exchange rates up to $1.6330 by early afternoon.

For a free currency consultation click here.

This morning saw the Office of National Statistics release its second GDP estimate for Q3 and with the figure falling in line with initial estimates. The report confirmed the UK economy has expanded by 0.8% which highlights once again the UK recovery is picking up speed.

Want to know when your target rate is available??? Click here

It wasn't only against the dollar that the pound rose. Sterling gained strength against all of the major currencies and once again briefly broke €1.20 against the euro.

However, with better than expected U.S. unemployment claims GBP/USD was unable to stay over $1.63. It was forecast there would be a rise in the number of people claiming for unemployment but with a reduction of 15,000 the greenback was able to claw back some lost ground and at the time of writing cable was down to $1.6265.

Today's movement shows just how volatile the FX markets can be, to put the movements into monetary terms a £200,000 trade into dollars would have varied by around $2,400 between the low and the high of the day.

It also shows just how important it is to get the timing right on your currency transfer. So if you need to buy or sell dollars in the coming weeks and want to ensure you are making the most of your money, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

What a day for the Pound! After this mornings GDP estimate, Sterling found some momentum against the U.S. dollar to reach its highest level since early January. Trade opened today with GBP/USD sitting just over $1.62, but a gain of nearly 0.75% pushed exchange rates up to $1.6330 by early afternoon.

For a free currency consultation click here.

This morning saw the Office of National Statistics release its second GDP estimate for Q3 and with the figure falling in line with initial estimates. The report confirmed the UK economy has expanded by 0.8% which highlights once again the UK recovery is picking up speed.

Want to know when your target rate is available??? Click here

It wasn't only against the dollar that the pound rose. Sterling gained strength against all of the major currencies and once again briefly broke €1.20 against the euro.

However, with better than expected U.S. unemployment claims GBP/USD was unable to stay over $1.63. It was forecast there would be a rise in the number of people claiming for unemployment but with a reduction of 15,000 the greenback was able to claw back some lost ground and at the time of writing cable was down to $1.6265.

Today's movement shows just how volatile the FX markets can be, to put the movements into monetary terms a £200,000 trade into dollars would have varied by around $2,400 between the low and the high of the day.

It also shows just how important it is to get the timing right on your currency transfer. So if you need to buy or sell dollars in the coming weeks and want to ensure you are making the most of your money, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Monday, 25 November 2013

GBP/USD falls to one month low

Good afternoon,

GBP/USD exchange rates fell today after weaker than expected UK mortgage numbers. Trading opened this morning with the Sterling/dollar cross sitting just below $1.6225 but the negative data caused rates to drop throughout the day to a low of $1.6134. Todays decline has left exchange rates at their lowest level for nearly a month and with little data out of the UK this week, the pounds performance looks likely to be determined by events elsewhere.

For a free currency consultation click here.

Figures released this morning by the British Bankers Association showed the number of mortgages taken out in October had fallen slightly compared to Septembers numbers. There were 42,808 new loans approved last month, a fall of only 375, but despite only a very small decline there was a relatively large impact on the pounds performance.

What can we expect this week?

As I have already mentioned there is not much to get excited about in terms of data releases from the UK, the only data of any real note will come on Wednesday when the Office of National Statistics release second Gross Domestic Product (GDP) estimate for quarter three. Any change from the first estimate and Wednesdays forecast reading of 0.8% could cause some sudden movements for the GDP/USD cross.

For commercial rates of exchange click here.

There are a few more releases over in the states this week which could impact the dollars value. Building permits and Consumer confidence numbers are due to be released on Tuesday, with Core durable good orders and Unemployment claims being released on Wednesday.

The U.S. economy is being closely watched at the moment and any improvements will add to speculation that the Federal Reserve could soon start to wind down its $85 billion monthly asset purchasing programme.

I will keep you updated throughout the week of how exchange rates are performing, but in the meantime if you have a requirement to buy or sell dollars and want to ensure you are making the most of your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

GBP/USD exchange rates fell today after weaker than expected UK mortgage numbers. Trading opened this morning with the Sterling/dollar cross sitting just below $1.6225 but the negative data caused rates to drop throughout the day to a low of $1.6134. Todays decline has left exchange rates at their lowest level for nearly a month and with little data out of the UK this week, the pounds performance looks likely to be determined by events elsewhere.

For a free currency consultation click here.

Figures released this morning by the British Bankers Association showed the number of mortgages taken out in October had fallen slightly compared to Septembers numbers. There were 42,808 new loans approved last month, a fall of only 375, but despite only a very small decline there was a relatively large impact on the pounds performance.

What can we expect this week?

As I have already mentioned there is not much to get excited about in terms of data releases from the UK, the only data of any real note will come on Wednesday when the Office of National Statistics release second Gross Domestic Product (GDP) estimate for quarter three. Any change from the first estimate and Wednesdays forecast reading of 0.8% could cause some sudden movements for the GDP/USD cross.

For commercial rates of exchange click here.

There are a few more releases over in the states this week which could impact the dollars value. Building permits and Consumer confidence numbers are due to be released on Tuesday, with Core durable good orders and Unemployment claims being released on Wednesday.

The U.S. economy is being closely watched at the moment and any improvements will add to speculation that the Federal Reserve could soon start to wind down its $85 billion monthly asset purchasing programme.

I will keep you updated throughout the week of how exchange rates are performing, but in the meantime if you have a requirement to buy or sell dollars and want to ensure you are making the most of your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Thursday, 21 November 2013

GBP/USD exchange rates recover

Good afternoon,

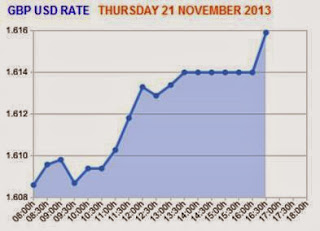

Since yesterdays post there has been quite a swing with the GBP/USD cross, after I mentioned Sterling/dollar was at its highest level for nearly a month, trading opened this morning with the exchange rate over a cent down and sitting at $1.6073. Reports the FED would look to start tapering in the coming months caused the dollar to strengthen, however, as markets opened this morning the greenback was unable to hold onto the gains as the pound clawed back the ground it had lost over the course of the day.

For a free, no-obligation currency consultation click here.

The day started well for the UK and the pound as the latest Public Net borrowing figures were released by the office of National Statistics. Although the number missed the predicted it is the third month running we have seen an improvement in the UK's finances.

For commercial rates of exchange click here.

The pound also rose against the dollar following Janet Yellen being nominated as the next FED chair by the U.S. Senate banking committee. She will now stand in front of the full Senate, but as the Senate is controlled by the Democrats it is now only a formality that she will take over from the current Chairman Ben Bernanke.

So why would Janet Yellen being nominated cause the dollar to weaken?

Although there have been calls for the Federal Reserve (FED) to start tapering sooner rather than later and yesterdays minutes documenting the FED want to start tapering in the coming months, it is still to be seen what action Janet Yellen will take.

She is thought to be very dovish when it comes to economic policy, which essentially means she is happy with the way the U.S. government are currently spending and the existing stimulus measures the FED are undertaking.

This has left market players and investors uncertain as to how she plans to tackle the existing issues surrounding the U.S. economy as her views are more or less the same as the Mr Bernanke's.

Until we are given some clear guidelines by the FED I would expect exchange rates to continue being relatively choppy. If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below to complete the contact or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Since yesterdays post there has been quite a swing with the GBP/USD cross, after I mentioned Sterling/dollar was at its highest level for nearly a month, trading opened this morning with the exchange rate over a cent down and sitting at $1.6073. Reports the FED would look to start tapering in the coming months caused the dollar to strengthen, however, as markets opened this morning the greenback was unable to hold onto the gains as the pound clawed back the ground it had lost over the course of the day.

For a free, no-obligation currency consultation click here.

The day started well for the UK and the pound as the latest Public Net borrowing figures were released by the office of National Statistics. Although the number missed the predicted it is the third month running we have seen an improvement in the UK's finances.

For commercial rates of exchange click here.

The pound also rose against the dollar following Janet Yellen being nominated as the next FED chair by the U.S. Senate banking committee. She will now stand in front of the full Senate, but as the Senate is controlled by the Democrats it is now only a formality that she will take over from the current Chairman Ben Bernanke.

So why would Janet Yellen being nominated cause the dollar to weaken?

Although there have been calls for the Federal Reserve (FED) to start tapering sooner rather than later and yesterdays minutes documenting the FED want to start tapering in the coming months, it is still to be seen what action Janet Yellen will take.

This has left market players and investors uncertain as to how she plans to tackle the existing issues surrounding the U.S. economy as her views are more or less the same as the Mr Bernanke's.

Until we are given some clear guidelines by the FED I would expect exchange rates to continue being relatively choppy. If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below to complete the contact or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Wednesday, 20 November 2013

GBP/USD exchange rates highest since 28th October

Good afternoon,

The pound rose against the dollar today after the Bank of England (BoE) released the minutes from its meeting at the start of November and the U.S posted some weaker than forecast numbers. Trading opened with GBP/USD exchange rates sitting just above $1.61 but over the course of the day rates gradually climbed to reach a high of $1.6177.

For a free currency consultation click here.

There was more positive news for the UK and the pound today as the minutes from Novembers Monetary Policy Committees (MPC) meeting revealed all nine members voted in favour of keeping the existing Quantitative Easing (QE) programme on hold and to keep interest rates at 0.5%.

The minutes also went on to show the committee believe that the UK recovery is taking shape and is not facing any major risks of inflation. Sterling immediately benefited from the news and pushed exchange rates towards $1.6050 for the first time since 28th October.

For commercial rates of exchange click here

The gains did not stop there as weaker than forecast Existing Home Sales and Consumer Price Index (CPI) data from the U.S caused the dollar to weaken in the afternoon taking the GBP/USD cross to a high of $1.6177.

Will the gains continue?

It will all depend on how the UK and U.S. economies continue to perform. The UK seems to be heading in the right direction and until the U.S. Federal Reserve sees sustained improvement in the U.S. economy it is unlikely we will see them start to cut back their current QE programme. The $85 billion the FED are pumping into the economy is one of the major reasons we have seen the dollar weaken during 2013. However, it is a matter of when not if until the FED do start to taper and once that happens I would expect the dollar to quickly recover some of the ground it has lost to the pound and euro over the past few months.

Until that time I am sure the volatility we have seen in the FX market over the last couple of weeks will continue. If you have a requirement to buy or sell dollars and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form

The pound rose against the dollar today after the Bank of England (BoE) released the minutes from its meeting at the start of November and the U.S posted some weaker than forecast numbers. Trading opened with GBP/USD exchange rates sitting just above $1.61 but over the course of the day rates gradually climbed to reach a high of $1.6177.

For a free currency consultation click here.

There was more positive news for the UK and the pound today as the minutes from Novembers Monetary Policy Committees (MPC) meeting revealed all nine members voted in favour of keeping the existing Quantitative Easing (QE) programme on hold and to keep interest rates at 0.5%.

The minutes also went on to show the committee believe that the UK recovery is taking shape and is not facing any major risks of inflation. Sterling immediately benefited from the news and pushed exchange rates towards $1.6050 for the first time since 28th October.

For commercial rates of exchange click here

The gains did not stop there as weaker than forecast Existing Home Sales and Consumer Price Index (CPI) data from the U.S caused the dollar to weaken in the afternoon taking the GBP/USD cross to a high of $1.6177.

Will the gains continue?

It will all depend on how the UK and U.S. economies continue to perform. The UK seems to be heading in the right direction and until the U.S. Federal Reserve sees sustained improvement in the U.S. economy it is unlikely we will see them start to cut back their current QE programme. The $85 billion the FED are pumping into the economy is one of the major reasons we have seen the dollar weaken during 2013. However, it is a matter of when not if until the FED do start to taper and once that happens I would expect the dollar to quickly recover some of the ground it has lost to the pound and euro over the past few months.

Until that time I am sure the volatility we have seen in the FX market over the last couple of weeks will continue. If you have a requirement to buy or sell dollars and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form

Monday, 18 November 2013

Pound/dollar exchange rate update

Good afternoon,

With no data coming out of the UK today, Sterling was at the mercy of events elsewhere and with nothing to support the pound the GBP/USD cross fell by over half a point. Trade opened this morning with exchange rates sitting at a high of $1.6147 but over the course of the day rates continuously dropped to reach a low of $1.6094.

For a free currency consultation click here.

What can we expect for Sterling/dollar?

It has been a turbulent few days for GBP/USD, in the last week we have seen rates as low as $1.5869 before recovering to reach $1.6150 (a gain of 1.75%). It looks as though the UK recovery is now firmly on track and with Mark Carney and the Bank of England raising the growth forecast for 2013 and 2014, Sterling was able to find some much needed support.

For commercial rates of exchange click here.

If the UK economy continues to perform well there is every chance we could see rates continue to rise which will be great news for anyone looking to purchase dollars, in fact, one of the forecasts I received this morning indicated we could see rates reach $1.64 within the next couple of weeks.

I personally think this is a little unrealistic as even when the U.S were close to reaching their debt ceiling exchange rates only just got over $1.62. If the U.S continues to under perform and the UK has a run of positive data we could see rates push towards a 2013 high but that would only just take us over $1.63.

However, lets not get to carried away! There have been reports in the last week that the U.S Federal Reserve could bring tapering to the table as early as December. If the FED were to look at reducing their extravagant bond buying programme from $85 billion dollars a month, there is every change we will see the dollar quickly strengthen which is likely to bring rates back below $1.60.

I think the next few weeks will continue to be pretty volatile for Sterling and the dollar, so if you have a requirement to buy or sell currency in the coming weeks it is important to know what tools are available to help you make the most form your transfer. Use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

With no data coming out of the UK today, Sterling was at the mercy of events elsewhere and with nothing to support the pound the GBP/USD cross fell by over half a point. Trade opened this morning with exchange rates sitting at a high of $1.6147 but over the course of the day rates continuously dropped to reach a low of $1.6094.

For a free currency consultation click here.

What can we expect for Sterling/dollar?

It has been a turbulent few days for GBP/USD, in the last week we have seen rates as low as $1.5869 before recovering to reach $1.6150 (a gain of 1.75%). It looks as though the UK recovery is now firmly on track and with Mark Carney and the Bank of England raising the growth forecast for 2013 and 2014, Sterling was able to find some much needed support.

For commercial rates of exchange click here.

If the UK economy continues to perform well there is every chance we could see rates continue to rise which will be great news for anyone looking to purchase dollars, in fact, one of the forecasts I received this morning indicated we could see rates reach $1.64 within the next couple of weeks.

I personally think this is a little unrealistic as even when the U.S were close to reaching their debt ceiling exchange rates only just got over $1.62. If the U.S continues to under perform and the UK has a run of positive data we could see rates push towards a 2013 high but that would only just take us over $1.63.

However, lets not get to carried away! There have been reports in the last week that the U.S Federal Reserve could bring tapering to the table as early as December. If the FED were to look at reducing their extravagant bond buying programme from $85 billion dollars a month, there is every change we will see the dollar quickly strengthen which is likely to bring rates back below $1.60.

I think the next few weeks will continue to be pretty volatile for Sterling and the dollar, so if you have a requirement to buy or sell currency in the coming weeks it is important to know what tools are available to help you make the most form your transfer. Use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Tuesday, 22 October 2013

GBP/USD exchange rates reach 3 week high!

Good afternoon,

GBP/USD exchange rates spiked this afternoon to reach the highest level we have seen since the 2nd October. Following the release of the latest U.S. job numbers the dollar quickly lost value pushing cable up by nearly a cent to reach $1.6226, meaning Sterling has now gained around 2% against the dollar since last Wednesday.

For a free currency consultation click here.

Today was an important day in the U.S. as we finally got to see the job numbers from September, they should have been released at the start of this month but due to the government shutdown the majority of data releases were delayed. The non-farm payroll numbers usually cause some big swings in the FX markets and todays result was no exception.

It had been predicted that 182,000 jobs were created last month but the actual figure (released at 13:30 BST) came in well under the forecast rate, only 148,000 new jobs were created and the result had an immediate impact on the dollars performance (as the graph below shows). In a matter of seconds GBP/USD climbed from $1.6125 to $1.6207 before gradually climbing over the rest of the afternoon.

So what does this mean for the U.S.?

We are still waiting to see what result the shutdown will have on the U.S. economy, this will become clearer over the next few weeks as we start to see the data for October being released. What todays job numbers will do is put any chance of the Federal Reserve cutting back their continuing Quantitative Easing programme in the immediate future on hold. It means the dollar will remain weakened and if the shutdown has had a negative impact on the economy we could see the dollars value depreciate even further.

Over the next few months there are going to be some major announcements in the States, so the volatility we have seen in recent weeks is sure to continue. As I have already mentioned we will start to see the results of the shutdown, Ben Bernanke is stepping down as FED chairman with Janet Yellen ready to take over and lets not forget that the deal to raise the U.S. debt ceiling was only a temporary one and could well lead to another stand-off between the Democrats and Republicans.

If you have a requirement to buy or sell dollars in the coming weeks or months and are worried about what will happen with exchange rates, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation currency consultation.

Click here to complete the contact form.

GBP/USD exchange rates spiked this afternoon to reach the highest level we have seen since the 2nd October. Following the release of the latest U.S. job numbers the dollar quickly lost value pushing cable up by nearly a cent to reach $1.6226, meaning Sterling has now gained around 2% against the dollar since last Wednesday.

For a free currency consultation click here.

Today was an important day in the U.S. as we finally got to see the job numbers from September, they should have been released at the start of this month but due to the government shutdown the majority of data releases were delayed. The non-farm payroll numbers usually cause some big swings in the FX markets and todays result was no exception.

It had been predicted that 182,000 jobs were created last month but the actual figure (released at 13:30 BST) came in well under the forecast rate, only 148,000 new jobs were created and the result had an immediate impact on the dollars performance (as the graph below shows). In a matter of seconds GBP/USD climbed from $1.6125 to $1.6207 before gradually climbing over the rest of the afternoon.

So what does this mean for the U.S.?

We are still waiting to see what result the shutdown will have on the U.S. economy, this will become clearer over the next few weeks as we start to see the data for October being released. What todays job numbers will do is put any chance of the Federal Reserve cutting back their continuing Quantitative Easing programme in the immediate future on hold. It means the dollar will remain weakened and if the shutdown has had a negative impact on the economy we could see the dollars value depreciate even further.

Over the next few months there are going to be some major announcements in the States, so the volatility we have seen in recent weeks is sure to continue. As I have already mentioned we will start to see the results of the shutdown, Ben Bernanke is stepping down as FED chairman with Janet Yellen ready to take over and lets not forget that the deal to raise the U.S. debt ceiling was only a temporary one and could well lead to another stand-off between the Democrats and Republicans.

If you have a requirement to buy or sell dollars in the coming weeks or months and are worried about what will happen with exchange rates, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation currency consultation.

Click here to complete the contact form.

Wednesday, 16 October 2013

Sterling suffers as potential agreement is reached by U.S.

Good afternoon,

GBP/USD exchange rates have fallen almost a cent and a half this afternoon as news broke that the U.S. government shutdown is about to come to an end. There was also more positive news that a temporary increase to the U.S. debt ceiling has been agreed until early February, wiping out any chance the States will default on their repayments.

For a free currency consultation click here.

The day had started in a positive fashion for Sterling as UK unemployment figures released at 09:30 (BST) showed the number of people out of work had fallen by 18,000 compared to the previous month. The data had an immediate impact on exchange rates with the GBP/USD cross pushing up to $1.6045, however, the gains were extremely short-lived as the news of the breakthrough over in the States meant the dollar quickly gained momentum causing exchange rates to plummet back down to $1.5896.

For commercial rates of exchange click here.

At the time of writing this post we are still waiting for the official report but if the deal between the Democrats and Republications is confirmed we could well see rates fall even further. If what is being said is true I would not be surprised to see rates fall back below $1.57 by tomorrow morning.

I will give you an update in the morning, as soon as I have all the relevant information but in the meantime if you would like to discuss the different options available to help make the most from your currency transaction please use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

To complete the contact form click here.

GBP/USD exchange rates have fallen almost a cent and a half this afternoon as news broke that the U.S. government shutdown is about to come to an end. There was also more positive news that a temporary increase to the U.S. debt ceiling has been agreed until early February, wiping out any chance the States will default on their repayments.

For a free currency consultation click here.

The day had started in a positive fashion for Sterling as UK unemployment figures released at 09:30 (BST) showed the number of people out of work had fallen by 18,000 compared to the previous month. The data had an immediate impact on exchange rates with the GBP/USD cross pushing up to $1.6045, however, the gains were extremely short-lived as the news of the breakthrough over in the States meant the dollar quickly gained momentum causing exchange rates to plummet back down to $1.5896.

For commercial rates of exchange click here.

At the time of writing this post we are still waiting for the official report but if the deal between the Democrats and Republications is confirmed we could well see rates fall even further. If what is being said is true I would not be surprised to see rates fall back below $1.57 by tomorrow morning.

I will give you an update in the morning, as soon as I have all the relevant information but in the meantime if you would like to discuss the different options available to help make the most from your currency transaction please use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

To complete the contact form click here.

Monday, 14 October 2013

GBP/USD exchange rates break $1.60

Good afternoon,

Sterling managed to climb against the dollar today as a cloud of uncertainty still hovers over the U.S economy. With only three days until the United States reach their debt ceiling GBP/USD exchange rates rose by over half a cent to once again break through the $1.60 barrier, the pound/dollar cross jumped from a low of $1.5956 to reach a high of $1.6014 as market players become increasingly concerned that a U.S. default may be on the cards.

For your free currency consultation click here.

Sterling managed to climb against the dollar today as a cloud of uncertainty still hovers over the U.S economy. With only three days until the United States reach their debt ceiling GBP/USD exchange rates rose by over half a cent to once again break through the $1.60 barrier, the pound/dollar cross jumped from a low of $1.5956 to reach a high of $1.6014 as market players become increasingly concerned that a U.S. default may be on the cards.

For your free currency consultation click here.

U.S. government have been is talks over the weekend to try and bring an end to the two financial crises the country is currently facing and although there were signs of an agreement being reached, it seems the Republicans and Democrats are still some way off any kind of agreement.

The government has been shutdown since the beginning of the month and the longer it continues the bigger the impact on the U.S. economy, they have already left hundreds of thousands of people on unpaid leave with no sign of when they will be going back to work.

On Thursday the U.S, face reaching their debt ceiling and if government officials cannot agree a temporary increase to what is essentially their overdraft they will face the embarrassing prospect of not being able to meet their financial obligations.

This would have a catastrophic impact on the U.S economy and the value of the greenback. If the worst was to happen the dollar would drop against a basket of the major currencies, potentially push GBP/USD exchange rates well past the highs we saw last year.

This would have a catastrophic impact on the U.S economy and the value of the greenback. If the worst was to happen the dollar would drop against a basket of the major currencies, potentially push GBP/USD exchange rates well past the highs we saw last year.

If you have a requirement to buy or sell dollars in the coming weeks or months and are concerned about where exchange rates are heading, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Wednesday, 9 October 2013

GBP/USD exchange rates continue to fall

Good afternoon,

It looks like the UK economic recovery may have run out of steam as poor data this morning meant the pound lost even more ground against the dollar over the course of trading today. GBP/USD exchange rates fell from $1.6050 to a low of $1.5921 despite the on-going U.S government shutdown and the possibility of a U.S default.

For a free currency consultation click here.

So what has caused today's movement?

Over the last couple of months the UK economy has been performing very well which in turn has boosted the pounds performance. It looked as though the UK was turning a corner and the recovery was quickly gaining momentum. However, what we have witnessed over the last week should act as a wakeup call and proves things aren't as rosy as we had all hoped.

Over the last couple of months the UK economy has been performing very well which in turn has boosted the pounds performance. It looked as though the UK was turning a corner and the recovery was quickly gaining momentum. However, what we have witnessed over the last week should act as a wakeup call and proves things aren't as rosy as we had all hoped.

This morning saw the release of the latest manufacturing production and industrial production figures, both of which were very disappointing. Manufacturing production had been forecast to rise by 0.3% but came in at -1.2% while industrial production also under performed coming in at -1.1%. The data had an immediate impact on the pound's value, dropping against most of its major counterparts to bring Sterling/dollar to the lowest level we have seen since the 18th September as the graph below shows.

So will rates recover?

As I have said a few times in the past, it is almost impossible to try and predict which way exchange rates will move, especially during this very volatile time. They key factor behind the GBP/USD crosses performance over the next few weeks will depend heavily on what happens in the U.S.

For commercial rates of exchange click here.

It seems the shutdown has now been priced into the mid-market price but the longer the government remain at loggerheads the bigger impact it will have in the long term. U.S. economic growth will start be affected which will force the Federal Reserve to continue the QE programme which in turn will continue to dent the dollars value.

There is also every chance the U.S. will reach their debt ceiling in eight days time and if an agreement cannot be reached it will leave the them unable to repay their debts. If that were to happen I can only really see exchange rates going one way and that is up, how far they will go though is anyone's guess!

Obviously this is all ifs and buts and if the shutdown comes to an end and government officials do agree to raise the debt ceiling we could see GBP/USD fall back even further. If you need to buy or sell dollars in the coming weeks and want ensure you are making the most from your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation currency consultation.

Click here to complete the contact form.

It looks like the UK economic recovery may have run out of steam as poor data this morning meant the pound lost even more ground against the dollar over the course of trading today. GBP/USD exchange rates fell from $1.6050 to a low of $1.5921 despite the on-going U.S government shutdown and the possibility of a U.S default.

For a free currency consultation click here.

So what has caused today's movement?

Over the last couple of months the UK economy has been performing very well which in turn has boosted the pounds performance. It looked as though the UK was turning a corner and the recovery was quickly gaining momentum. However, what we have witnessed over the last week should act as a wakeup call and proves things aren't as rosy as we had all hoped.

Over the last couple of months the UK economy has been performing very well which in turn has boosted the pounds performance. It looked as though the UK was turning a corner and the recovery was quickly gaining momentum. However, what we have witnessed over the last week should act as a wakeup call and proves things aren't as rosy as we had all hoped. This morning saw the release of the latest manufacturing production and industrial production figures, both of which were very disappointing. Manufacturing production had been forecast to rise by 0.3% but came in at -1.2% while industrial production also under performed coming in at -1.1%. The data had an immediate impact on the pound's value, dropping against most of its major counterparts to bring Sterling/dollar to the lowest level we have seen since the 18th September as the graph below shows.

So will rates recover?

As I have said a few times in the past, it is almost impossible to try and predict which way exchange rates will move, especially during this very volatile time. They key factor behind the GBP/USD crosses performance over the next few weeks will depend heavily on what happens in the U.S.

For commercial rates of exchange click here.

It seems the shutdown has now been priced into the mid-market price but the longer the government remain at loggerheads the bigger impact it will have in the long term. U.S. economic growth will start be affected which will force the Federal Reserve to continue the QE programme which in turn will continue to dent the dollars value.

There is also every chance the U.S. will reach their debt ceiling in eight days time and if an agreement cannot be reached it will leave the them unable to repay their debts. If that were to happen I can only really see exchange rates going one way and that is up, how far they will go though is anyone's guess!

Obviously this is all ifs and buts and if the shutdown comes to an end and government officials do agree to raise the debt ceiling we could see GBP/USD fall back even further. If you need to buy or sell dollars in the coming weeks and want ensure you are making the most from your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation currency consultation.

Click here to complete the contact form.

Monday, 7 October 2013

GBP/USD exchange rate monday update.

Good afternoon,

Sterling managed to climb back towards $1.61 today as the U.S. government shutdown shows no signs of ending. Trading opened with the GBP/USD cross sitting just above $1.6030 but as they day went on exchange rates climbed to reach a high of $1.6096. With no data coming out of the UK, U.S. or Eurozone today the on-going stalemate in the States continued to dominate the news. For more information on live rates of exchange call me directly on 0044 (0) 1442 892 065.

It has been a tricky few days for the pound, with all the problems facing the U.S. at the moment you might of thought the pound would continue to gain strength against the troubled U.S. dollar. However, with the UK construction and service sectors, along with the Halifax Price index failing to impress last week the GBP/USD cross was unable hold above $1.62. Although last weeks numbers weren't a total shambles it does show the UK economy is not out of the woods just yet and should act as reminder not to get too far ahead of ourselves.

Until the shutdown in the U.S. comes to an end questions will continue to be raised about the impact it will have on the U.S. economy. From the news coming out of Washington at the moment it doesn't look like things will be resolved anytime soon and there a growing concerns the shutdown is starting to affect business.

For a free currency consultation click here.

It is likely the number of people being forced to take unpaid leave will increase over the next few days as more companies face being closed down due to political stubbornness. The more companies that close the bigger the impact on U.S economy, which in turn will de-value the dollar and reduce the chance we will see the U.S Federal Reserve starting to wind down their current QE programme before the end of year.

Everyday that passes also brings us closer to a U.S. default. Government officials have until the 17th October to raise the debt ceiling or face the prospect of not being able to pay their bills. I think it is unlikely that will happen but if it does GBP/USD would quickly rise.

If you have a requirement to buy or sell dollars and are concerned about what is happening with exchange rates at the moment, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free no-obligation consultation.

Click here to complete the contact form.

Sterling managed to climb back towards $1.61 today as the U.S. government shutdown shows no signs of ending. Trading opened with the GBP/USD cross sitting just above $1.6030 but as they day went on exchange rates climbed to reach a high of $1.6096. With no data coming out of the UK, U.S. or Eurozone today the on-going stalemate in the States continued to dominate the news. For more information on live rates of exchange call me directly on 0044 (0) 1442 892 065.

It has been a tricky few days for the pound, with all the problems facing the U.S. at the moment you might of thought the pound would continue to gain strength against the troubled U.S. dollar. However, with the UK construction and service sectors, along with the Halifax Price index failing to impress last week the GBP/USD cross was unable hold above $1.62. Although last weeks numbers weren't a total shambles it does show the UK economy is not out of the woods just yet and should act as reminder not to get too far ahead of ourselves.

Until the shutdown in the U.S. comes to an end questions will continue to be raised about the impact it will have on the U.S. economy. From the news coming out of Washington at the moment it doesn't look like things will be resolved anytime soon and there a growing concerns the shutdown is starting to affect business.

For a free currency consultation click here.

It is likely the number of people being forced to take unpaid leave will increase over the next few days as more companies face being closed down due to political stubbornness. The more companies that close the bigger the impact on U.S economy, which in turn will de-value the dollar and reduce the chance we will see the U.S Federal Reserve starting to wind down their current QE programme before the end of year.

Everyday that passes also brings us closer to a U.S. default. Government officials have until the 17th October to raise the debt ceiling or face the prospect of not being able to pay their bills. I think it is unlikely that will happen but if it does GBP/USD would quickly rise.

If you have a requirement to buy or sell dollars and are concerned about what is happening with exchange rates at the moment, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free no-obligation consultation.

Click here to complete the contact form.

Thursday, 3 October 2013

GBP/USD exchange rate update

Good afternoon,

Despite the government shutdown the dollar managed to claw back some of the ground it lost to the pound during trading today. Since Tuesday morning the GBP/USD exchange rates have been pushing towards $1.6250 but following some weaker than expected UK data and positive unemployment news from the U.S, rates dipped back below $1.6170.

For a free currency consultation click here.

With the saga surrounding the U.S continuing and with no end to the shutdown in sight the door was open for the pound to push up even higher today. However, with the Halifax House Price index (which measures the change in price in houses financed by HBOS) and UK Services PMI both missing initial forecasts Sterling was could not even hold its current level and slowly slipped over the course of the morning.

The dollars gains did not stop there as we witnessed another drop for the GBP/USD cross in the afternoon. The U.S weekly unemployment claims ,which show the number of people who have filed for unemployment benefit, came in 7K under the predicted level to bring exchange rates down to the low of the day.

So what is round the corner?

So far the U.S government has only implemented a partial shutdown which has left 700,000 people out of work with little chance of claiming back pay. The longer the shutdown continues the more impact it is going to have on rates of exchange.

For commercial rates of exchange click here.

As it stands national parks, tourist sites, government websites, office buildings, have been closed which includes some of the companies that release U.S economic figures. Tomorrow should have seen the release of the non-farm payroll numbers, which normally cause some huge swings for the GBP/USD cross, if the data can not be released it may cause the dollar to weaken even more.

The new budget is not the only issue government officials currently face, there is a potentially more dangerous prospect on the horizon which could leave the U.S unable to meet their financial obligations.

On the 17th October the States will reach their debt limit which will basically leave them with no cash to pay their bills. Unless Congress can reach an agreement to raise the debt ceiling we may see the worlds largest economy default on their payments. This would be catastrophic for the U.S and the dollar and if the worst was to happen we would see the dollars value plummet in a matter of minutes.

If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from your currency transaction, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free no-obligation consultation.

Click here to complete the contact form.

Tuesday, 1 October 2013

GBP/USD exchange rates reach fresh high

Good morning,

The dollar has lost ground against most of the major currencies this morning after the U.S government failed to reach an agreement over a new spending plan. U.S officials had until midnight (EST) to thrash out a new budget but failure to do so left the U.S economy facing some very uncertain times. For a free currency consultation click here or call 0044 (0) 1442 892 065

As the news broke the dollar immediately devalued pushing GBP/USD to a 2013 high. Exchange rates rose to $1.6257 the best we have seen the cross since December 2012 and means the pound has gained over 7.5% against the greenback since the start of August. To put the move into perspective a £200,000 trade will now see you receive nearly $23,000 more compared to the same trade booked on the 2nd August.

So what can we expect from the U.S now?

A government shutdown could have some long term effects on the U.S economy, for a start we are still not sure how long the shutdown will last, but the longer it goes on the worse it is going to be. It is rumoured the shut down could last as long as three weeks and if that happens U.S GDP is going to take a bit of a hammering.

If GDP drops (which is more than likely) it will also be bad news for the Federal Reserve as they had been looking for improvements in the economy before they can begin cutting back on their quantitative easing (QE) programme. The longer QE goes on for the harder it will be for FED officials to take the first step which will mean the dollar will take longer to recover.

For the best rate of exchange click here.

It has also left investors airing on the side of caution as it now looks like we will not see any major data releases while the shutdown continues. If investors cannot see how the U.S is performing then they will be forced to put their money elsewhere and with the UK seeming to be on the road to recovery we may see the pound used as a safe-haven which would push GBP/USD exchange rates even higher.

All in all the U.S is now facing a tricky situation and the next few weeks will be critical for the dollars short term future. Lets not forget that on the 17th October the U.S faces reaching it debt ceiling and if that also happens it could leave the U.S unable to meet its financial obligations.

If you need to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

The dollar has lost ground against most of the major currencies this morning after the U.S government failed to reach an agreement over a new spending plan. U.S officials had until midnight (EST) to thrash out a new budget but failure to do so left the U.S economy facing some very uncertain times. For a free currency consultation click here or call 0044 (0) 1442 892 065

As the news broke the dollar immediately devalued pushing GBP/USD to a 2013 high. Exchange rates rose to $1.6257 the best we have seen the cross since December 2012 and means the pound has gained over 7.5% against the greenback since the start of August. To put the move into perspective a £200,000 trade will now see you receive nearly $23,000 more compared to the same trade booked on the 2nd August.

So what can we expect from the U.S now?

A government shutdown could have some long term effects on the U.S economy, for a start we are still not sure how long the shutdown will last, but the longer it goes on the worse it is going to be. It is rumoured the shut down could last as long as three weeks and if that happens U.S GDP is going to take a bit of a hammering.

If GDP drops (which is more than likely) it will also be bad news for the Federal Reserve as they had been looking for improvements in the economy before they can begin cutting back on their quantitative easing (QE) programme. The longer QE goes on for the harder it will be for FED officials to take the first step which will mean the dollar will take longer to recover.

For the best rate of exchange click here.

It has also left investors airing on the side of caution as it now looks like we will not see any major data releases while the shutdown continues. If investors cannot see how the U.S is performing then they will be forced to put their money elsewhere and with the UK seeming to be on the road to recovery we may see the pound used as a safe-haven which would push GBP/USD exchange rates even higher.

All in all the U.S is now facing a tricky situation and the next few weeks will be critical for the dollars short term future. Lets not forget that on the 17th October the U.S faces reaching it debt ceiling and if that also happens it could leave the U.S unable to meet its financial obligations.

If you need to buy or sell dollars in the coming weeks and want to ensure you are making the most from you transfer, use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Monday, 30 September 2013

GBP/USD exchange rates climb again

Good afternoon,

Since my last post Sterling has climbed nearly two cents to reach $1.62, the highest GBP/USD exchange rates have been since the 3rd January. The pounds performance has been boosted by the news the U.S government is facing a shut down at midnight (EST) unless a new spending bill can be agreed. For more information on live exchange rates click here.

Unless a new plan is agreed before midnight it means from the 1st of October the U.S Government will be forced to shut down for the first time in 17 years. Millions of employees are expected to stop work potentially leaving the U.S economy in a state of disarray.