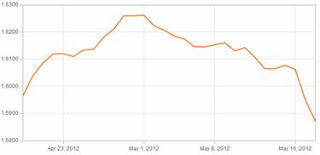

Last week saw sterling continue to fall against the safe haven U.S dollar, as rates slipped to their lowest levels for two months. Cable has been on the decline since rates hit an eight month high of $1.6304 only three weeks ago. In this week’s report we will take a closer look at what has been responsible for driving the rates down.

It was a relatively quiet start to the week in terms data releases in the UK and the U.S as all eyes were focused on Wednesday as we had unemployment data and the Bank of England (BoE) inflation report, with both potentially having an impact onto the value of the pound.

As the results surfaced Sterling

Bank of England Governor Mervyn King indicated that the UK

Talk of a Greek default has surfaced yet again and policymakers are concerned that Greece UK recovery and result in the BoE adding to their asset purchasing scheme by pumping more money into the UK

No-one is 100% sure what will happen with exchange rates should Greece Spain , Italy , Portugal and Ireland

One of the only positives for the UK

On Thursday and Friday there were no data releases from the UK US on Thursday saw a small change to Sterling

But as is the case when the markets are so volatile it wasn’t long before more negative data from the Euro-zone increased investor appetite for the greenback and the dollar was back on the march. A cut in Greece

If you need to convert currency and want to achieve the best pound/dollar exchange rates it is vital you know what options are available. You can protect yourself against rates moving the wrong way, trying to guess which way the market is going to move and leaving your transaction to the last minute could prove very costly. You can contact me by clicking here to send me a direct email or by completing the contact form on the homepage of the blog.