A run of positive

With so much talk in recent weeks regarding quantitative easing, Wednesday’s data will have given the pound some much needed breathing space. UK Mortgage Approvals for April came in higher than expected along with UK Consumer Credit which is released by the Bank of England (BoE) and shows the amount of money borrowed by private individuals. The higher figure for both data releases could be seen as positive for the UK

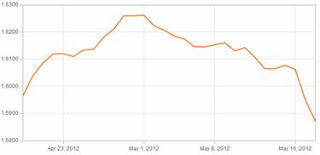

Even with the positive news sterling continued to fall against the dollar as Spain UK

If you need to buy dollars in the next few months contact me for a free consultation to make the most from your currency transfer. To put the recent movements into perspective a £200,000 trade performed today will see you receive around $15,600 less than the same trade performed just three weeks ago. It shows you how quickly things can change and why it is important to protect yourself from adverse movements. Click here to send me a direct email or complete the contact form on the homepage of the blog