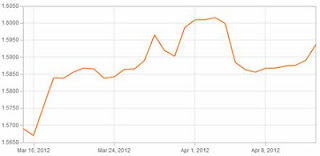

Last week saw pound/dollar exchange rates remain relatively stable despite a host of data releases from the U.S, UK and Europe . Following the $1.60 highs we saw before Easter the GBP/USD cross finished the week more or less as it started as the graph below shows.

Pound/dollar rates fell by over a point at the start of the week despite the positive news that UK

The dollar’s gains early in the week were down to a drop in appetite for riskier currencies, recent PMI data from the Euro has indicated a contraction in activity while rising costs to insure Spanish and Italian debt prompted investors to head back across the pond to the safe haven status of the US dollar

Over the last few weeks the pound has been supported by improving construction and manufacturing data and Wednesday’s news that UK retail sales rose for the month of March have added to expectations that the UK

Towards the end of the week Sterling

As we have said before there are a range of forecasts that indicate that pound/dollar rates could fall towards $1.50 over the coming months, mainly due to the continuing problems in the Euro-zone. For this reason it is imperative you stay in contact as a sudden movement in the market could prove costly. Click here to send me a direct email or complete the contact form on the homepage of the blog.

As we have said before there are a range of forecasts that indicate that pound/dollar rates could fall towards $1.50 over the coming months, mainly due to the continuing problems in the Euro-zone. For this reason it is imperative you stay in contact as a sudden movement in the market could prove costly. Click here to send me a direct email or complete the contact form on the homepage of the blog.