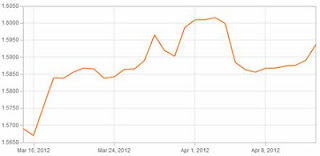

As I mentioned last week, the rise of the pound has come as a bit of a surprise considering the UK

As sterling broke through the $1.63 barrier the U.S dollar slipped to a two month low against a number of currencies, mainly due to weak U.S growth data released on Friday. This has added to expectations the Fed could extend its U.S monetary policy.

Later this week we have a number of data releases coming from the U.S which could add extra weight to an already heavy load. Tuesday sees Construction Spending, vehicle sales, Manufacturing, and the first of two speeches from FED chairman Ben Bernanke. Wednesday will see employment data, mortgage applications and factory orders. On Thursday there is the second speech from the FED, while on Friday, average earnings and the latest unemployment rates is released. We will also see Non-Farm Payrolls, which often causes volatility for GBP/USD rates.

I will keep you posted of how the data affects the pound/dollar cross but if you need to buy or sell dollars over the next few days or would like to discuss how to reduce the risk of the currency markets click here to send me a direct email or complete the contact form on the homepage of the blog.