Good afternoon,

Sterling continued its recent surge against the dollar as the cross climbed by over half a cent during trading today. Starting the day at $1.6614, GBP/USD exchange rates rose throughout the day to reach a high of 1.6675, the highest we have seen rates since 13th March. Today's move means the pound has now gained nearly 1.3% in the last week, wiping out the gains made by the dollar following the U.S. Federal Reserves tapering announcement on the 20th.

For a free currency consultation click here.

To put the last weeks movements into monetary terms, a £200,000 trade into dollars will now see you receive around $4.100 more compared to the same trade secured last Monday. It once again highlights how quickly things can change in the FX markets and how important it is to know what tools are available if you are thinking about buying or selling dollars.

What are some of the tools available?

Forward contract

A forward contract can help protect you from adverse market movements and is useful for managing your budget. You set the price now for a transaction that will take place up to two years in the future, allowing you to fix the exact value of the currency to be paid regardless of market fluctuations.

You secure the forward contract with a margin of 10% of the total value of your transaction (you’ll need to pay this within two working days of agreeing the contract) and then pay the balance before the contract expires. Once secured, the agreed exchange rate will apply for the duration of the contract.

Limit order

With a limit order you specify the rate you are hoping to achieve – a price that may not be currently available. Your currency will automatically be purchased if the market exceeds this rate, meaning you get the price you want. This type of contract is particularly useful when the markets are moving in a positive direction for you.

Stop loss order

A stop loss order instructs me to buy your currency if the exchange rate goes down to a pre-determined level. When combined with a limit order, you can hold out for a better rate knowing you are protected from a sudden fall in the market.

If you have a requirement to buy or sell dollars in the coming weeks and would like to know what rates of exchange I can offer or would like more information on the different types of currency contract, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892065.

Click here to complete the contact form.

Market Reports published by Senior Currency Broker Arron Morris, forecasts and data that can impact pound/dollar exchange rates. Used by those that need to buy or sell U.S Dollars at commercial exchange rates. Our rates are better than those available at banks or other financial institutions, so contact me today to see how much you can save on your currency transaction.

Monday, 31 March 2014

Wednesday, 26 March 2014

GBP/USD exchange rates stage a fightback

Good afternoon,

Sterling has managed to fight back against the dollar since Monday with the GBP/USD exchange rate pushing back towards $1.66. In my last post cable was down at $1.6467 but over the last 48 hours Sterling has managed to gain around 0.7% against the dollar with most of the gains seen during trading today.

For a free currency consultation click here.

Since trading opened this morning the GBP/USD cross has risen from $1.6510 to $1.6581 (the highest we have seen since the pair since 19th February). Sterling started to make ground yesterday following some positive housing data which showed house prices were up 6.8% compared to this time last year and coupled with the latest UK inflation data, which keeps us close to the Bank of England target of 2% the pound was able put an end to the declines we have witnessed over the last seven days.

Want to you when your desired rate is available? Click here.

If you have to exchange funds in the coming days it is important to know what to look out for. Thursday will probably be the key day in terms of economic data releases this week. Tomorrow will see the release of the latest UK retail figures and in the States we will see final GDP figures for Q4 and pending house sales numbers, which if positive could strengthen the case for further cuts by the U.S. Federal Reserve.

If you have a requirement to buy or sell dollars and want to ensure you are making the most from your currency transfer, contact me today to find out what tools are available to either help protect you against any adverse market movements or target a rate that might not be currently available.

To contact me you can use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Sterling has managed to fight back against the dollar since Monday with the GBP/USD exchange rate pushing back towards $1.66. In my last post cable was down at $1.6467 but over the last 48 hours Sterling has managed to gain around 0.7% against the dollar with most of the gains seen during trading today.

For a free currency consultation click here.

Want to you when your desired rate is available? Click here.

If you have to exchange funds in the coming days it is important to know what to look out for. Thursday will probably be the key day in terms of economic data releases this week. Tomorrow will see the release of the latest UK retail figures and in the States we will see final GDP figures for Q4 and pending house sales numbers, which if positive could strengthen the case for further cuts by the U.S. Federal Reserve.

If you have a requirement to buy or sell dollars and want to ensure you are making the most from your currency transfer, contact me today to find out what tools are available to either help protect you against any adverse market movements or target a rate that might not be currently available.

To contact me you can use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Monday, 24 March 2014

GBP/USD exchange rates stay in 40 pip range

Good afternoon,

With the volatility we witnessed last week for the Sterling/dollar today has been fairly uneventful. GBP/USD exchange rates stayed within a 40 pip range, fluctuating from $1.6467 to $1.6508. As today has been relatively quite, in today's post I will give you a quick overview of todays events and look at what could impact rates for the rest of the week.

For a free currency consultation click here.

The only data of note to be released today was the latest flash manufacturing PMI from the States. The PMI data is a survey of around 600 purchasing managers which ask them rate current business conditions which include production, inventories and employment. A score of 50.0 indicates growth in the industry and although today's figure came in at 55.5 it did miss the forecast score of 56.6, though it will not cause any major issues for the dollar as it looks to build on last weeks gains.

What could impact rates this week?

Tuesday – From the UK we have inflation data, CBI realised sales survey and mortgage approvals. And State side we will see a consumer confidence report, a speech from FOMC member Plosser and the latest new home sales.

Wednesday – No major releases from the UK today but from the U.S we will get Durable goods orders and

crude oil inventories.

I will of course keep you updated throughout the week but in the mean time if you have requirement to buy or sell dollars in the coming days and want to make the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

With the volatility we witnessed last week for the Sterling/dollar today has been fairly uneventful. GBP/USD exchange rates stayed within a 40 pip range, fluctuating from $1.6467 to $1.6508. As today has been relatively quite, in today's post I will give you a quick overview of todays events and look at what could impact rates for the rest of the week.

For a free currency consultation click here.

The only data of note to be released today was the latest flash manufacturing PMI from the States. The PMI data is a survey of around 600 purchasing managers which ask them rate current business conditions which include production, inventories and employment. A score of 50.0 indicates growth in the industry and although today's figure came in at 55.5 it did miss the forecast score of 56.6, though it will not cause any major issues for the dollar as it looks to build on last weeks gains.

What could impact rates this week?

Tuesday – From the UK we have inflation data, CBI realised sales survey and mortgage approvals. And State side we will see a consumer confidence report, a speech from FOMC member Plosser and the latest new home sales.

Thursday – A busy day and likely to cause a fair bit of volatility as we see the latest Retail sales data from the UK. The U.S release their latest Unemployment numbers,

final GDP figures and pending home sales.

Friday – Another important day for the UK as the ONS release the monthly current account and

final GDP figures. We also get Inflation data, personal spending figures and a

consumer sentiment survey from the US.

I will of course keep you updated throughout the week but in the mean time if you have requirement to buy or sell dollars in the coming days and want to make the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Thursday, 20 March 2014

The dollar rallies after Fed announcement

Good afternoon,

As I predicted yesterday GBP/USD exchange rates did fall back below the $1.66 mark. Last night the U.S. Federal Reserve announced that a further $10 billion will be cut from the current stimulus package, meaning they have now trimmed the bond buying programme for three consecutive months.

For a free currency consultation click here.

The news had an immediate impact on the FX markets, Sterling fell from $1.6665 to $1.6625 in matter of minutes and the dollars gains did not stop there. As the UK and European markets opened and had a chance to react, GBP/USD fell even further and reached a low of $1.6485 by lunch time today.

It wasn't only the news of further tapering which helped the dollars cause though. Fed Chair Janet Yellen also helped support the dollar by issuing some guidance in regards to a potential interest rise. Under former Chairman Ben Bernanke the Fed came across as cagey about when a rise would take place, but thanks to Mrs Yellen's comments she has now set some clear parameters about when the first increase will take place. During her statement Mrs Yellen indicated that interest rates could rise as soon as the current stimulus package has been wound up, this could mean we may see a rate hike in just six months time.

Now that some guidance has been issued I think the dollar has a real chance of making further gains. If we cast our mind back to last year to when Bank of England Governor Mark Carney employed a similar policy, the pound benefited hugely from improved investor confidence and went on a real march. There is now a real possibility that the dollar will follow suit and if that happens it might not be to long until we see GBP/USD back under $1.60.

If you have a requirement to buy or sell dollars and want to make sure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

As I predicted yesterday GBP/USD exchange rates did fall back below the $1.66 mark. Last night the U.S. Federal Reserve announced that a further $10 billion will be cut from the current stimulus package, meaning they have now trimmed the bond buying programme for three consecutive months.

For a free currency consultation click here.

The news had an immediate impact on the FX markets, Sterling fell from $1.6665 to $1.6625 in matter of minutes and the dollars gains did not stop there. As the UK and European markets opened and had a chance to react, GBP/USD fell even further and reached a low of $1.6485 by lunch time today.

It wasn't only the news of further tapering which helped the dollars cause though. Fed Chair Janet Yellen also helped support the dollar by issuing some guidance in regards to a potential interest rise. Under former Chairman Ben Bernanke the Fed came across as cagey about when a rise would take place, but thanks to Mrs Yellen's comments she has now set some clear parameters about when the first increase will take place. During her statement Mrs Yellen indicated that interest rates could rise as soon as the current stimulus package has been wound up, this could mean we may see a rate hike in just six months time.

Now that some guidance has been issued I think the dollar has a real chance of making further gains. If we cast our mind back to last year to when Bank of England Governor Mark Carney employed a similar policy, the pound benefited hugely from improved investor confidence and went on a real march. There is now a real possibility that the dollar will follow suit and if that happens it might not be to long until we see GBP/USD back under $1.60.

If you have a requirement to buy or sell dollars and want to make sure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Wednesday, 19 March 2014

Sterling climbs but could be set for a fall

Good afternoon,

After dipping on Tuesday, Sterling fought back against the dollar during trading today to reach a high of $1.6665. The dollar made inroads against most of its major counterparts last night and this morning following reports the U.S. Federal Reserve are set to taper for the third month running. The news left GBP/USD exchange rates floating around $1.6548, a drop of over a cent since my last post on Monday.

For a free currency consultation click here.

The pound was able to bounce back though as UK unemployment figures released this morning showed the number of people out of work had fallen by 63,000. Coupled with a positive speech from Chancellor George Osborne where he said Britain was recovering and growing at a faster pace than any other major economy (which warranted revising the growth forecast for 2014), the pound was able to shake off the dollars latest advances and climb back to the exact levels we witnessed on Monday afternoon.

Want to know when your desired rate is available? Click here.

However, lets not get to carried away, there is every chance we will see GBP/USD drop back below $1.66 in the next few hours. As I have already mentioned it is looking highly likely the Fed will announce another cut to their bond buying programme later this afternoon. The on-going stimulus programme being implemented by the Fed currently stands at $65 billion but it looks as though that will be cut by a further $10 billion by the end of today. If that happens the dollar has every chance of strengthening which in turn will drive down GBP/USD exchange rates.

The pound has lost nearly two cents against the dollar in recent weeks and further losses could be on the cards, if Fed Chair Janet Yellen paints a positive picture about the U.S. economy. If what we are led to believe is true and Fed do wind up the stimulus programme by the end of this year Sterling may struggle to sustain levels over $1.60 in the coming months.

For that reason if you are looking to purchase dollars in the coming months and want to ensure you are making the most from your currency transfer it is important to know what options are available. As a specialist currency broker I have a range of tools at my disposal that can protect you against adverse market movements or help target a rate that might not be currently available.

For more information use the link below and complete the contact form or call me directly on

0044 (0) 1442 892 065.

Click here to complete the contact form.

After dipping on Tuesday, Sterling fought back against the dollar during trading today to reach a high of $1.6665. The dollar made inroads against most of its major counterparts last night and this morning following reports the U.S. Federal Reserve are set to taper for the third month running. The news left GBP/USD exchange rates floating around $1.6548, a drop of over a cent since my last post on Monday.

For a free currency consultation click here.

The pound was able to bounce back though as UK unemployment figures released this morning showed the number of people out of work had fallen by 63,000. Coupled with a positive speech from Chancellor George Osborne where he said Britain was recovering and growing at a faster pace than any other major economy (which warranted revising the growth forecast for 2014), the pound was able to shake off the dollars latest advances and climb back to the exact levels we witnessed on Monday afternoon.

Want to know when your desired rate is available? Click here.

However, lets not get to carried away, there is every chance we will see GBP/USD drop back below $1.66 in the next few hours. As I have already mentioned it is looking highly likely the Fed will announce another cut to their bond buying programme later this afternoon. The on-going stimulus programme being implemented by the Fed currently stands at $65 billion but it looks as though that will be cut by a further $10 billion by the end of today. If that happens the dollar has every chance of strengthening which in turn will drive down GBP/USD exchange rates.

The pound has lost nearly two cents against the dollar in recent weeks and further losses could be on the cards, if Fed Chair Janet Yellen paints a positive picture about the U.S. economy. If what we are led to believe is true and Fed do wind up the stimulus programme by the end of this year Sterling may struggle to sustain levels over $1.60 in the coming months.

For that reason if you are looking to purchase dollars in the coming months and want to ensure you are making the most from your currency transfer it is important to know what options are available. As a specialist currency broker I have a range of tools at my disposal that can protect you against adverse market movements or help target a rate that might not be currently available.

For more information use the link below and complete the contact form or call me directly on

0044 (0) 1442 892 065.

Click here to complete the contact form.

Monday, 17 March 2014

GBP/USD exchange rates hold their ground

Good afternoon,

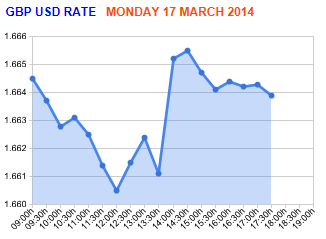

Sterling held its ground against the dollar today despite some positive numbers being released from the States. Trading opened this morning with the GBP/USD cross sitting just above $1.6651. However, the pound started to lose some ground as industrial production figures from the States came in 0.4% higher than forecast. The news saw the mid-market rate drop to a daily low of $1.6605, but the dollar was unable to hold onto the gains and by the middle of the afternoon the pound had fought back with GBP/USD rising to $1.6665.

For a free currency consultation click here.

Todays industrial production figures will once again give the U.S. a glimmer of hope that their economy may be recovering. The Federal Reserve (Fed) were only expecting the industrial production figures to rise by 0.2% today but with the actual number coming in at 0.6% the positive reading is sure to add to speculation that the Fed will look to make further reductions to their bond buying scheme later this week.

The Fed are due to start a two day meeting on Tuesday and their have been hints from some policy makers that another cut to the stimulus programme is on the cards. Over the last few months the Fed have cut $20 billion from the programme which currently stands at $65 billion. Fed Char Janet Yellen recently said the U.S. economy was strong enough to cope with the reductions and if investors agree we could start to see the dollar strengthen.

The next few days are also going to important for the pound. This week sees the UK release its annual budget report along with the latest unemployment figures and Bank of England minutes. I don't think the minutes are going to bring any surprises but if we see another rise in unemployment then the pound could lose some ground as it takes us further from the BoE's target rate.

I will of course keep you posted of the weeks events but in the meantime, if you have a requirement to buy or sell dollars and want to ensure you are making the most from your transfer use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation

Click here to complete the contact form.

Friday, 14 March 2014

GBP/USD exhange rates recover slightly

Good afternoon,

The U.S. dollar was unable to take full advantage of the lack of data from the UK this week as GBP/USD exchange rates climbed back above $1.66 this afternoon. Following Wednesdays dip, leaving Sterling/Dollar rates at $1.6572, there was scope for the greenback to make further gains as the U.S. released some key figures in the form of PPI data and consumer confidence.

For a free consultation click here.

However, as we have seen on a number of occasions over the last few months the U.S. are unable to string together a good run of data releases and todays numbers will again raise question marks over the strength of the U.S recovery.

All of today's figures failed to meet market expectations and the news had an immediate impact on the GBP/USD cross. The pound gained around half a cent against the dollar with the mid-market price climbing from $1.6588 to $1.6638 on the news, drawing clear from the one month low we witnessed earlier in the week.

Next week is sure to see further volatility for the GBP/USD pairing as the UK release its latest unemployment figures as well as the minutes from the most recent Bank of England meeting. Stateside, the U.S. Federal Reserve will announce their latest interest decision and Janet Yellen will give a press conference regarding monetary policy, which may give further clues regarding the on-going stimulus programme.

What can we expect to see for GBP/USD?

It is still extremely difficult to try and predict, the UK recovery seems to have tailed off slightly in recent weeks but with the U.S economy continuing to miss its targets it looks as though exchange will continue to sit between $1.67 and $1.65 for the foreseeable future.

There is still speculation that the dollar will strengthen when the FED wind up their QE programme but so far the $20 billion they have already cut has made little difference. Some are saying we will see rates back below $1.60 in the not so distant future but for the moment we will just have to wait and see.

If you are thinking of buying or selling dollars in the next few months and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065.

To complete the contact form click here.

The U.S. dollar was unable to take full advantage of the lack of data from the UK this week as GBP/USD exchange rates climbed back above $1.66 this afternoon. Following Wednesdays dip, leaving Sterling/Dollar rates at $1.6572, there was scope for the greenback to make further gains as the U.S. released some key figures in the form of PPI data and consumer confidence.

For a free consultation click here.

However, as we have seen on a number of occasions over the last few months the U.S. are unable to string together a good run of data releases and todays numbers will again raise question marks over the strength of the U.S recovery.

All of today's figures failed to meet market expectations and the news had an immediate impact on the GBP/USD cross. The pound gained around half a cent against the dollar with the mid-market price climbing from $1.6588 to $1.6638 on the news, drawing clear from the one month low we witnessed earlier in the week.

Next week is sure to see further volatility for the GBP/USD pairing as the UK release its latest unemployment figures as well as the minutes from the most recent Bank of England meeting. Stateside, the U.S. Federal Reserve will announce their latest interest decision and Janet Yellen will give a press conference regarding monetary policy, which may give further clues regarding the on-going stimulus programme.

What can we expect to see for GBP/USD?

It is still extremely difficult to try and predict, the UK recovery seems to have tailed off slightly in recent weeks but with the U.S economy continuing to miss its targets it looks as though exchange will continue to sit between $1.67 and $1.65 for the foreseeable future.

There is still speculation that the dollar will strengthen when the FED wind up their QE programme but so far the $20 billion they have already cut has made little difference. Some are saying we will see rates back below $1.60 in the not so distant future but for the moment we will just have to wait and see.

If you are thinking of buying or selling dollars in the next few months and want to ensure you are making the most from your transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065.

To complete the contact form click here.

Wednesday, 12 March 2014

GBP/USD exchange rates drop again.

Good afternoon,

Today has seen a half point swing for GBP/USD exchange rates. When trading opened this morning rates were sitting just above $1.6620 but Sterling continued its recent slide against the dollar as the cross fell to a low of $1.6572. The lowest we have seen the currency pair since the 12th February.

For a free currency consultation click here.

Today's move means the pound has now lost nearly 1.5% against the dollar in the last three weeks and as I mentioned in Monday's post, the lack of data coming out of the UK leaves the door well and truly open for the dollar to strengthen.

When dealing with currency a 1.5% move may not sound like much but for a business with invoices to pay or for a private client looking to purchase a property a decline in exchange rates all of a sudden leaves you in a position to find extra funds. To put the decline over the last three weeks into perspective a £200,000 trade into dollars will now see you receive around $4,500 less compared to the same trade secured on the 17th February.

As I have said on a numerous occasions over the last few weeks there is growing speculation that we will start to see the dollar strengthen over the course of 2014. If the U.S. Federal Reserve continue to cut their stimulus package it should only be a matter of time before the dollars value starts to benefit. The current stimulus package was one on the main reasons why GBP/USD climbed over 13% in the last 12 months and if the programme is wound up by the end of the year it is more than likely we see the dollar begin to fight back.

As a specialist currency broker I can offer a range of currency contracts to help you make the most from your transfer, even if you don't require your funds straight away. If you wanted to protect yourself against adverse market movements or target a rate that might not be currently available I can certainly help.

For more information on the types of currency contracts or to see what rate of exchange I can offer, use the link below and complete the contact form for a free, no-obligation consultation. Alternatively call me on my direct line 0044 (0) 1442 892 065.

Click here to complete the contact form.

Today has seen a half point swing for GBP/USD exchange rates. When trading opened this morning rates were sitting just above $1.6620 but Sterling continued its recent slide against the dollar as the cross fell to a low of $1.6572. The lowest we have seen the currency pair since the 12th February.

For a free currency consultation click here.

Today's move means the pound has now lost nearly 1.5% against the dollar in the last three weeks and as I mentioned in Monday's post, the lack of data coming out of the UK leaves the door well and truly open for the dollar to strengthen.

When dealing with currency a 1.5% move may not sound like much but for a business with invoices to pay or for a private client looking to purchase a property a decline in exchange rates all of a sudden leaves you in a position to find extra funds. To put the decline over the last three weeks into perspective a £200,000 trade into dollars will now see you receive around $4,500 less compared to the same trade secured on the 17th February.

As I have said on a numerous occasions over the last few weeks there is growing speculation that we will start to see the dollar strengthen over the course of 2014. If the U.S. Federal Reserve continue to cut their stimulus package it should only be a matter of time before the dollars value starts to benefit. The current stimulus package was one on the main reasons why GBP/USD climbed over 13% in the last 12 months and if the programme is wound up by the end of the year it is more than likely we see the dollar begin to fight back.

As a specialist currency broker I can offer a range of currency contracts to help you make the most from your transfer, even if you don't require your funds straight away. If you wanted to protect yourself against adverse market movements or target a rate that might not be currently available I can certainly help.

For more information on the types of currency contracts or to see what rate of exchange I can offer, use the link below and complete the contact form for a free, no-obligation consultation. Alternatively call me on my direct line 0044 (0) 1442 892 065.

Click here to complete the contact form.

Monday, 10 March 2014

GBP/USD exchange rates lose over a cent

Good afternoon,

A lack of UK economic data and positive numbers from the Eurozone meant Sterling suffered against most of major currencies today. When trading opened this morning GBP/USD exchange rates were hovering just over $1.6750 but with the pound at the mercy of events elsewhere, GBP/USD lost over a cent and at one point the mid-market rate was as low as $1.6622, the lowest we have seen the cross since the end of February.

For a free currency consultation click here.

This week could see the dollar make further inroads into the pounds value. With no data releases from the UK on Thursday or Friday the dollar has a real to chance to claw back some of the ground it has lost against Sterling over the past six months.

So what could impact rates for the rest of the week?

Apart from Trade balance figures on Wednesday there is little else coming out of the UK this week. Stateside, the Treasury department release their monthly statement which is followed by a speech from the Treasury secretary. We will also see the latest retail sales data, unemployment figures, import prices and business inventories and if the majority are positive, their is every chance the drop we have seen for GBP/USD could continue.

Want to know when your preferred rate is available? click here

How far rates could fall is impossible to predict but it is feasible to suggest that we could see rates drop back below $1.65. This would be great news for anyone selling dollars, especially after the run Sterling has had over the last few months.

If you are thinking of buying dollars it is still a great time to secure your rate, with forecasts suggesting the dollar will start to strengthen throughout 2014 we may not see rates remain over $1.65 for much longer. Even if you don't require the dollars straight away I can help you secure your rate to take advantage of the current levels.

With a forward contract you can secure your rate now and hold it at that level for up to two years into the future. This is a great tool if you are a business or a private client to help you budget and give you peace of mind.

For more information on the types of currency contract I can offer or to get live market prices use the link below and complete the contact form or call me direct on 0044 (0) 1442 892 065.

Click here to complete the contact form.

A lack of UK economic data and positive numbers from the Eurozone meant Sterling suffered against most of major currencies today. When trading opened this morning GBP/USD exchange rates were hovering just over $1.6750 but with the pound at the mercy of events elsewhere, GBP/USD lost over a cent and at one point the mid-market rate was as low as $1.6622, the lowest we have seen the cross since the end of February.

For a free currency consultation click here.

This week could see the dollar make further inroads into the pounds value. With no data releases from the UK on Thursday or Friday the dollar has a real to chance to claw back some of the ground it has lost against Sterling over the past six months.

So what could impact rates for the rest of the week?

Apart from Trade balance figures on Wednesday there is little else coming out of the UK this week. Stateside, the Treasury department release their monthly statement which is followed by a speech from the Treasury secretary. We will also see the latest retail sales data, unemployment figures, import prices and business inventories and if the majority are positive, their is every chance the drop we have seen for GBP/USD could continue.

Want to know when your preferred rate is available? click here

How far rates could fall is impossible to predict but it is feasible to suggest that we could see rates drop back below $1.65. This would be great news for anyone selling dollars, especially after the run Sterling has had over the last few months.

If you are thinking of buying dollars it is still a great time to secure your rate, with forecasts suggesting the dollar will start to strengthen throughout 2014 we may not see rates remain over $1.65 for much longer. Even if you don't require the dollars straight away I can help you secure your rate to take advantage of the current levels.

With a forward contract you can secure your rate now and hold it at that level for up to two years into the future. This is a great tool if you are a business or a private client to help you budget and give you peace of mind.

For more information on the types of currency contract I can offer or to get live market prices use the link below and complete the contact form or call me direct on 0044 (0) 1442 892 065.

Click here to complete the contact form.

Friday, 7 March 2014

GBP/USD exchange rates fall on the back of US job numbers

Good afternoon,

Sterling lost nearly half a per cent against the dollar today as the U.S. posted better than expected job numbers this afternoon. As I mentioned in Wednesday's post the U.S. job figures usually cause some volatility in the FX markets and today was no different.

For a free currency consultation click here.

At midday Sterling was sitting at $1.6783, the highest we have seen GBP/USD exchange rates since 17th February and very close the highest levels we have seen since 2009, but after the jobs data was released Sterling started to fall and by 4pm had dropped to a low of $1.6709.

It had been forecast that the U.S. had created 149,000 new jobs in February but the actual figure exceeded expectations and came in at 175,000. The gains for the dollar could have been greater had it not been for a survey showing that the number of long-term unemployed, that figure increased by over 203,000 compared to figures in January to leave 3.8 million people out of work.

So what can we expect for the GBP/USD cross now.

The rise in long-term unemployment will cause some concern for the U.S. Federal Reserve but overall they will be pleased with the recent economic numbers that are coming out of the States. Today's job numbers will lend some extra support towards the FED continuing to cut their on-going stimulus package when they meet later in the month.

Further cuts to the stimulus programme could see the dollar strengthen further which means we could see GBP/USD exchange rates back below $1.65 in the next few weeks.

If you need to buy or sell dollars in the coming months and want to ensure you are making the most from you currency transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Sterling lost nearly half a per cent against the dollar today as the U.S. posted better than expected job numbers this afternoon. As I mentioned in Wednesday's post the U.S. job figures usually cause some volatility in the FX markets and today was no different.

For a free currency consultation click here.

At midday Sterling was sitting at $1.6783, the highest we have seen GBP/USD exchange rates since 17th February and very close the highest levels we have seen since 2009, but after the jobs data was released Sterling started to fall and by 4pm had dropped to a low of $1.6709.

It had been forecast that the U.S. had created 149,000 new jobs in February but the actual figure exceeded expectations and came in at 175,000. The gains for the dollar could have been greater had it not been for a survey showing that the number of long-term unemployed, that figure increased by over 203,000 compared to figures in January to leave 3.8 million people out of work.

So what can we expect for the GBP/USD cross now.

The rise in long-term unemployment will cause some concern for the U.S. Federal Reserve but overall they will be pleased with the recent economic numbers that are coming out of the States. Today's job numbers will lend some extra support towards the FED continuing to cut their on-going stimulus package when they meet later in the month.

Further cuts to the stimulus programme could see the dollar strengthen further which means we could see GBP/USD exchange rates back below $1.65 in the next few weeks.

If you need to buy or sell dollars in the coming months and want to ensure you are making the most from you currency transfer, use the link below to complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Wednesday, 5 March 2014

GBP/USD rates climb again

Good afternoon,

After losing over a cent against the dollar since Monday, Sterling managed to rally against a basket of currencies during trading today with GBP/USD exchange rates climbing back over $1.67. When I came into the office this morning Cable was sitting just above $1.6655 but after more positive data for the UK the pound managed to climb and reach a high of $1.6750 for second time this week.

For a free currency consultation click here.

Since my last post Sterling had lost a bit of ground against the dollar after UK construction figures, which were released on Tuesday, had shown the sector had not grown as quickly as everyone had hoped. The data resulted in GBP/USD rates dropping back to a low of $1.6641 (the lowest we have seen the cross for nearly a week).

It did not take long for the pound to recover though as today's service sector figures (which are a leading indicator into how the UK economy is performing) beat analyst expectations to once again show the UK recovery is firmly taking hold.

Want to know when your target rate is available? click here.

Todays movements mean we have now seen a 0.65% swing in GBP/USD exchange rates over the past three days and I would expect to see further movements for the rest of the week. Tomorrow sees the Bank of England meeting for their monthly interest rate decision, although it is highly unlikely we will see a increase in rates, we could still see some movement in the FX markets as investors try to predict when we will actually see a rise.

On Friday we will also see the latest U.S. job numbers which will show us how many jobs were created in February. This piece of data is notorious for causing major movements in exchange rates and I would expect nothing else this time round when the results are published on Friday afternoon.

I will of course keep you updated with how the next couple of days pan out, in the meantime, if you have a requirement to buy or sell dollars in the coming months there are a couple of ways to contact me to ensure you are making the most from your currency transfer.

Use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Monday, 3 March 2014

GBP/USD exchange rate update

Good afternoon,

Today has seen GBP/USD exchange rates fluctuate by half a cent throughout trading today with the cross swaying between $1.6750 and $1.67. When I came into the office this morning Sterling/Dollar was sitting just above the $1.67 mark but after better UK manufacturing and mortgage approval data rates climbed to $1.6750, the highest we have seen the cross since the 17th February. However, the gains were short-lived as positive economic data from the U.S quickly saw the dollar claw back the lost ground.

For a free currency consultation click here.

With signs in recent weeks that the UK recovery maybe slowing todays key releases seem to have put pay to that idea, for the time being at least. Sterling benefitted this morning from the latest UK manufacturing and mortgage approval numbers, with both exceeding expectations.

The UK manufacturing sector was only expected to record a reading of 56.5 but the actual reading came in at 56.9 (a reading over 50 indicates growth in the sector), rising from 56.6 in January and with employment in the sector growing at its fastest pace for nearly three years the pounds value quickly rose across the board.

The good news did not stop there as UK mortgage approvals in January also showed that the UK recovery is back on track. The number of mortgages approved in January was the highest we have seen since 2007, well before the financial crisis hit in 2008. This bodes well for the housing market over the next few months as it means we should see a rise in the number of property completions. The housing market plays a key role for the UK economy and a rise in the sector should help cement the UK economic recovery which in turn will help boost the pounds performance.

So will exchange rates continue to rise?

At the moment it seems there is some scope for GBP/USD exchange rates to keep on climbing, over the past few weeks the U.S economy has not been as consistent as everyone had hoped. The U.S seem to be stuck in a bit of a rut at the moment but if they can build on today's positive Personal Spending and Income numbers we may start see the dollars value increase.

Lets not forget that one of the main reasons we have seen rates climb by over 13% in recent months has been down to the issues in the U.S, if they can put together a run of positive economic data releases and the U.S Federal Reserve continue to cut the on-going stimulus programme there is every chance the dollar will start to fight back.

How far exchange rates will drop is hard to say but there are a number of forecasts saying we could see rates back below $1.60 in the next three to six months.

If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from your transfer, use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Today has seen GBP/USD exchange rates fluctuate by half a cent throughout trading today with the cross swaying between $1.6750 and $1.67. When I came into the office this morning Sterling/Dollar was sitting just above the $1.67 mark but after better UK manufacturing and mortgage approval data rates climbed to $1.6750, the highest we have seen the cross since the 17th February. However, the gains were short-lived as positive economic data from the U.S quickly saw the dollar claw back the lost ground.

For a free currency consultation click here.

The UK manufacturing sector was only expected to record a reading of 56.5 but the actual reading came in at 56.9 (a reading over 50 indicates growth in the sector), rising from 56.6 in January and with employment in the sector growing at its fastest pace for nearly three years the pounds value quickly rose across the board.

The good news did not stop there as UK mortgage approvals in January also showed that the UK recovery is back on track. The number of mortgages approved in January was the highest we have seen since 2007, well before the financial crisis hit in 2008. This bodes well for the housing market over the next few months as it means we should see a rise in the number of property completions. The housing market plays a key role for the UK economy and a rise in the sector should help cement the UK economic recovery which in turn will help boost the pounds performance.

So will exchange rates continue to rise?

At the moment it seems there is some scope for GBP/USD exchange rates to keep on climbing, over the past few weeks the U.S economy has not been as consistent as everyone had hoped. The U.S seem to be stuck in a bit of a rut at the moment but if they can build on today's positive Personal Spending and Income numbers we may start see the dollars value increase.

Lets not forget that one of the main reasons we have seen rates climb by over 13% in recent months has been down to the issues in the U.S, if they can put together a run of positive economic data releases and the U.S Federal Reserve continue to cut the on-going stimulus programme there is every chance the dollar will start to fight back.

How far exchange rates will drop is hard to say but there are a number of forecasts saying we could see rates back below $1.60 in the next three to six months.

If you have a requirement to buy or sell dollars in the coming weeks and want to ensure you are making the most from your transfer, use the link below and complete the contact form or call me directly on 0044 (0) 1442 892 065 for a free, no-obligation consultation.

Click here to complete the contact form.

Subscribe to:

Comments (Atom)